Central bank speak continues to be dominated by concerns over inflation. In January, European Central Bank President Christine Lagarde spoke of the need to ‘stay the course’ with interest rate rises to tame price pressures. These macroeconomic factors – tightening monetary policy and high inflation – are not just preoccupying the minds of monetary policy committees at central banks. Reserve managers too are presumably concerned about their impact on capital preservation and volatility.

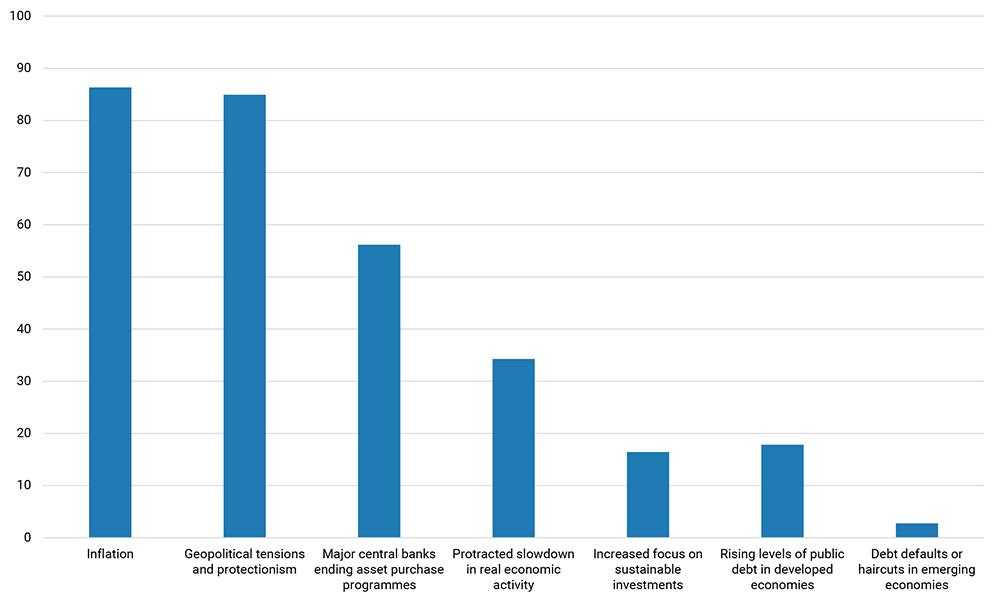

This was a key theme which emerged from OMFIF’s Global Public Investor 2022 report. Our survey of 73 central bank reserve managers last year showed that close to 90% saw inflation as one of the three most important factors affecting their performance (Figure 1).

Figure 1. Inflation was the principal concern for reserve managers in 2022

What are the three most important factors affecting reserve management in the current economic environment? Share of respondents, %

Source: OMFIF GPI 2022 survey

Source: OMFIF GPI 2022 survey

Almost half expected inflation to remain sustainably high over the next 24 months and had accepted a lower real return on their investments. In this environment, respondents signalled a clear intention to move away from longer maturity government bonds and towards the shorter end of the curve to reduce duration exposure.

As we gear up towards our GPI 2023 report – the 10th edition of OMFIF’s flagship publication – the impact of the macroeconomic environment on asset allocation will remain a key focus.

Global inflation is at, or close to, a peak suggesting that concerns over price pressures may be waning. Reserve managers may be lured back into longer maturity bonds, which offer attractive yields by past standards. This was a trend seen in the Global Public Pensions 2022 survey covering public pension and sovereign funds across the world.

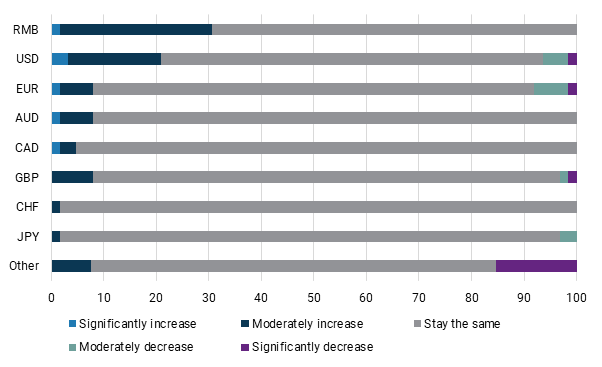

Another key trend we will continue to examine is reserve managers’ outlook for currencies. We flagged last year that a net 12% of central banks intended to increase their holdings of dollar assets over the coming 12-24 months. We explained this was ‘indicative of immediate-term movement to preserve capital and avoid volatility’ in a deteriorating macroeconomic environment, rather than part of a long-term strategy. Subsequently, safe-haven demand for the greenback was a key factor underpinning its broad-based appreciation in 2022.

Perhaps more revealing was that a net 30% of central banks stated their intention to increase their exposure to the renminbi (Figure 2). This was in stark contrast to the relative pessimism shown by global public funds on China. Central banks’ willingness to move into renminbi assets was mainly pinned on strategic rather than near-term factors, including diversification (81%) and the rising importance of the currency to the global economy (73%).

Figure 2. Reserve managers were keen to increase renminbi and dollar holdings

Over the next 12-24 months, are you planning to increase, reduce or maintain your exposure to the following currencies? Share of respondents, %

Source: OMFIF GPI 2022 survey

Source: OMFIF GPI 2022 survey

However, following the stringent sanctions placed on Russia in 2022, geopolitics and the weaponisation of finance are becoming increasingly important factors for reserve managers to consider. Geopolitics was already the main concern for reserve managers in investing in renminbi assets last year (noted by 70% of respondents). And with US-China tensions running high, some reserve managers may hesitate to increase their exposure to renminbi assets. Gold may be a beneficiary in this environment.

Finally, another key theme to consider is the impact of global flows and foreign exchange intervention on reserves. International Monetary Fund data show that, in the 12 months to November, global foreign exchange reserves fell by more than 7%. In many cases, this reflects the draw-down of reserves in commodity-importing economies in the face of higher food and energy prices.

That’s been a particular issue for countries with underlying balance of payments issues. Sri Lanka effectively ran out of reserves last year, plunging the economy into a crisis. Ghana, Egypt and Malawi have seen their reserves rapidly diminish too, prompting sharp currency declines and a turn to the IMF for emergency financing. Other emerging markets may follow suit this year.

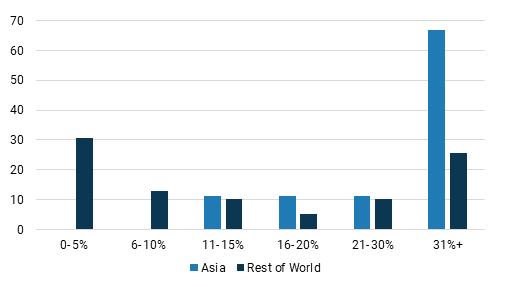

Elsewhere, the drop in foreign exchange reserves over the past year partly reflects deliberate intervention by policy-makers to protect their currencies against the dollar’s relentless rise. Our GPI 2022 survey showed that those in Asia were more willing to undertake significant intervention compared to other regions (Figure 3). This seemed to play out last year. Policy-makers in Japan, Korea, India and Thailand all dipped into their ample foreign exchange reserves to counteract the weakness in their currencies.

Figure 3. Asian economies were more willing to significantly draw-down their reserves

What is the maximum share of your reserves you would be willing to use in the event of a currency crisis? Share of respondents, %

Source: OMFIF GPI 2022 survey

Source: OMFIF GPI 2022 survey

In recent months, the dollar has come off the boil which has alleviated the need for further intervention. This has been underpinned by falling US inflation, expectations of a more dovish Federal Reserve (which could be premature) and more optimism over the global economic outlook. These factors, if sustained, would form the basis for the rebuilding of foreign exchange reserves in many economies.

Accordingly, it is not just monetary policy committees hoping for benign macroeconomic conditions in 2023. This will be top of the wish list for reserve managers too.

Nikhil Sanghani is Managing Director, Research at OMFIF.