We at OMFIF were shocked and saddened to hear about the tragic death of Japan’s former prime minister, Shinzo Abe. Our thoughts are with our friends, colleagues and contacts in Japan during a period of national mourning. This commentary was written just prior to this sad event and is testimony to the way Mr Abe helped us think about economic policy.

Despite other central banks flexing their muscles, Japan’s authorities have every reason to prolong a policy loosening in its 24th year. While the Bank of Japan’s monetary dials stay tuned to fight deflation, expect little reversal of the Ministry of Finance’s fiscal stimulus during Covid-19 – three budget expansions totalling ¥127tn ($93bn) or 23% of gross domestic product – and little prospect of quantitative easing ending. In this respect, the late former prime minister Shinzo Abe’s three policy pillars – of monetary and fiscal largesse and structural reform – should be extended.

The BoJ’s resistance to quantitative tightening was made clear in mid-June when, in the face of higher bond yields, it forcefully added liquidity to re-anchor the 10-year government bond yield onto its 0.25% target. This line in the sand had been tested by market vigilantes questioning Japan’s quantitative easing resolve at a time when the Federal Reserve and the Bank of England are tightening via two levers (higher rates and passive quantitative tightening), and the European Central Bank is set to raise rates. This line has since held firm.

Figure 1. GDP levels since the start of Japan’s economy-wide deflation

Nominal GDP re-based to Q1 1995 (=100). Blocks denote US (grey) and Japanese (orange) recessions.

Source: Refinitiv Datastream, National Bureau of Economic Research and Economic and Social Research Institute

Source: Refinitiv Datastream, National Bureau of Economic Research and Economic and Social Research Institute

Global inflation is admittedly rising, but the uplift in Japan does not look convincing. Even though Japan’s consumer price index has, in line with global pressures, returned to positive territory (an average +1.0% year on year since September 2021), its more representative, economy-wide GDP deflator has stubbornly remained negative (-1.1% yoy through the period).

The main benefit of Japan’s QE has been to suppress long yields and debt service costs for an economy whose net government liabilities to GDP ratio (approaching 250%) remains the highest in the developed world. On growth, there are no counterfactuals. But previous rounds of monetary and fiscal stimuli were losing their edge even before the pandemic slowed consumption and export growth, with the yen, unhelpfully, then buoyed by safe-haven flows.

Figure 1 illustrates the extent of Japan’s nominal GDP underperformance since running deflation in the mid-1990s. After 27 years, it looks barely back to square one. With deflation a twin evil in this respect – both eating into nominal GDP (though, arithmetically, boosting it in real terms), and raising the real value of debt – its government debt ratios monitored by ratings agencies have blown up.

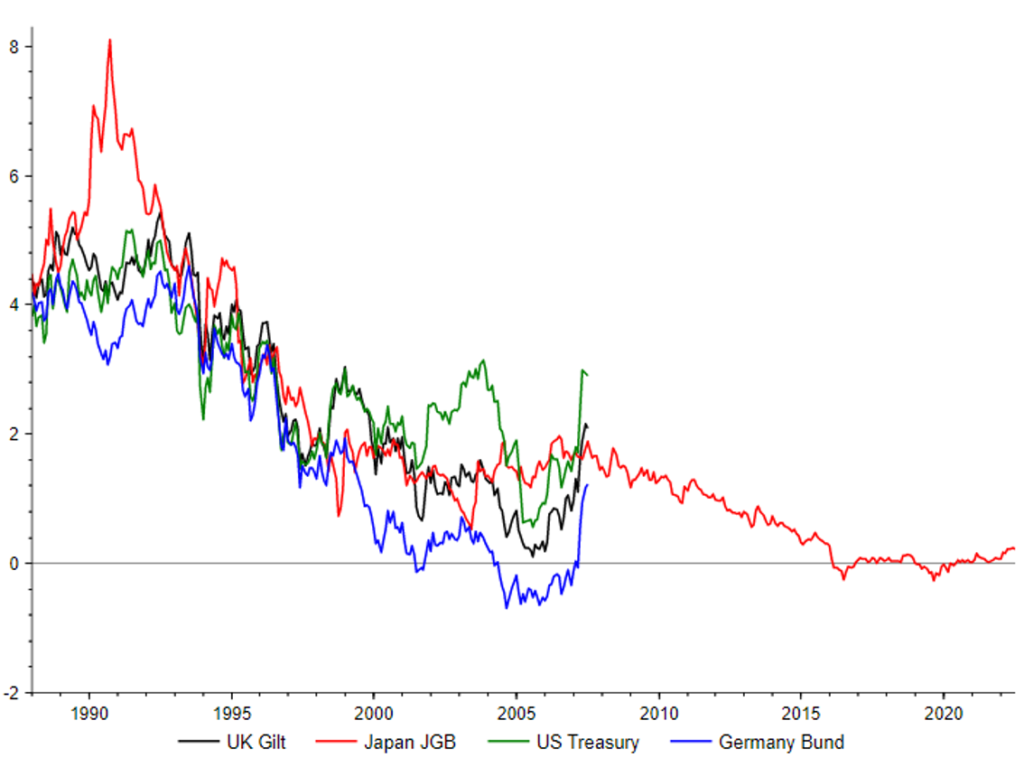

Figure 2. Is Japan still leading the way?

10-year JGB yield versus others, lagged 15 years (%)

Source: Refinitiv Datastream

Source: Refinitiv Datastream

Depending on where global yields go, Japan’s QE can now vary, reflecting the need to meet the BoJ’s 10-year yield target. This was set at close to zero in April 2016 but was allowed in March 2022 to drift up to 0.25%. This was the BoJ’s token tightening. Compared with monetary actions elsewhere (the Fed’s total 150bp on rates and the BoE’s 115bp, with both running QT, and the ECB set to hike), Japan’s inaction stands out. And, via QE, its benchmark bond yield rise looks dwarfed by others’ (Figure 2).

By virtue of its yield target, any QE rise as a result of global forces will be seen as a relative loosening. Part of the logic is that extending QE and delaying short rate rises beyond the asset purchase schemes of other major central banks leaves domestic institutions especially looking overseas for yield, hopefully (from an inflation-generating aspect) further softening the yen.

Otherwise, one of the most visible hits from deflation falls on the highly indebted government. By setting a target, the MoF now strives to get nominal growth (averaging -0.6% yoy since Q4 2021) back above the long-term interest rate, to borrow without raising the debt ratio. This dependency led some officials to concede long before Covid-19 that the BoJ would be the last central bank to stop QE.

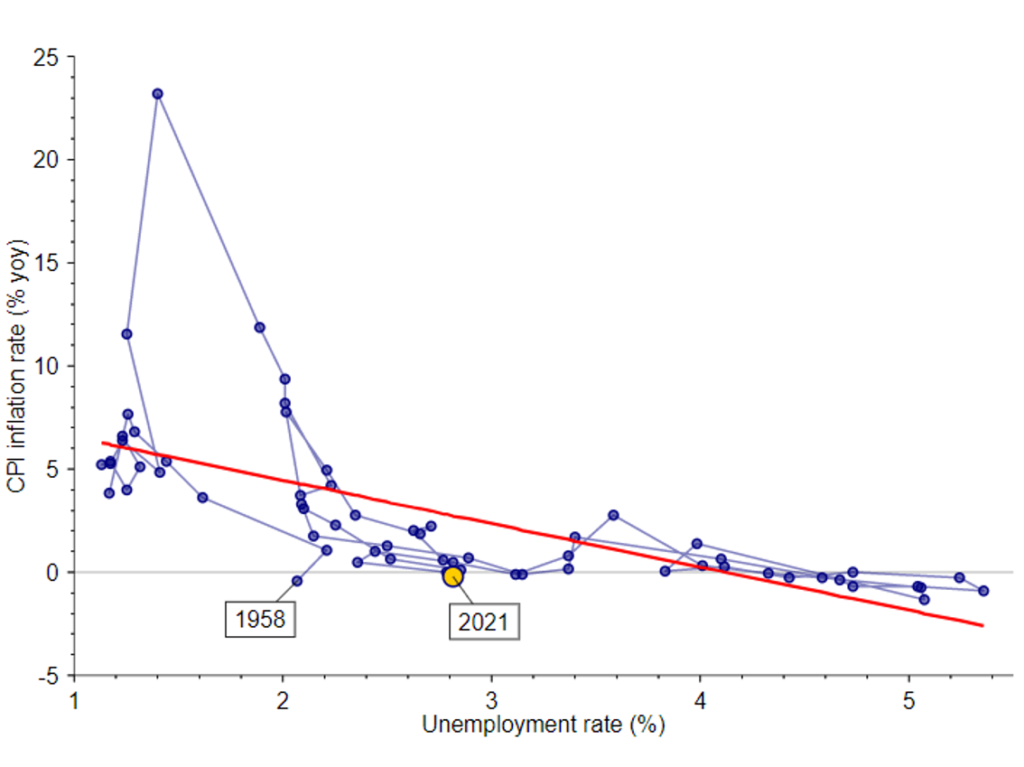

Figure 3. Sustained wage increases would probably spark inflation

Fitted Phillips curve, showing trade-off between unemployment rate (%) and CPI inflation (% yoy)

Source: Refinitiv Datastream

Source: Refinitiv Datastream

What would probably help inflation is a meaningful period of wage growth, but this has been lacking. Next spring’s collective wage round (shunto) will again be critical. Figure 3 suggests sustained wage growth would probably lift the CPI, given the decade of unemployment falls before 2019, and relative steepness of Japan’s Phillips curve. BoJ research concurs, having for some time identified a negatively sloped curve and greater long-term wage responsiveness than in the US, for example.

In the meantime, Japan’s QE will have to continue and policy rates stay suppressed, leaving the MoF increasingly reliant on the BoJ as its monetary agent. Yet, deep in Japan’s liquidity trap, it’s doubtful that easier money alone will prove any different in terms of breaking Japan’s deflationary psychology. Abe was, therefore, right to believe that other policy strands – including fiscal and structural reform – would be needed.

Neil Williams is Chief Economist at OMFIF.