2021 was a difficult year for fixed income investors, particularly those exposed primarily to high-quality government bonds. Even short-duration, investment-grade fixed income, widely regarded as the poster child for conservative fixed-income investing, delivered a slightly negative return for the first time in nearly 30 years.

Why is this happening? Low yields from developed market bonds have failed to offset the negative price return from bonds in a rising interest rate environment. The road ahead is a challenging one from a total returns standpoint, likely to be characterised by low absolute – albeit rising – yields and negative price returns as central banks move to normalise policy rates.

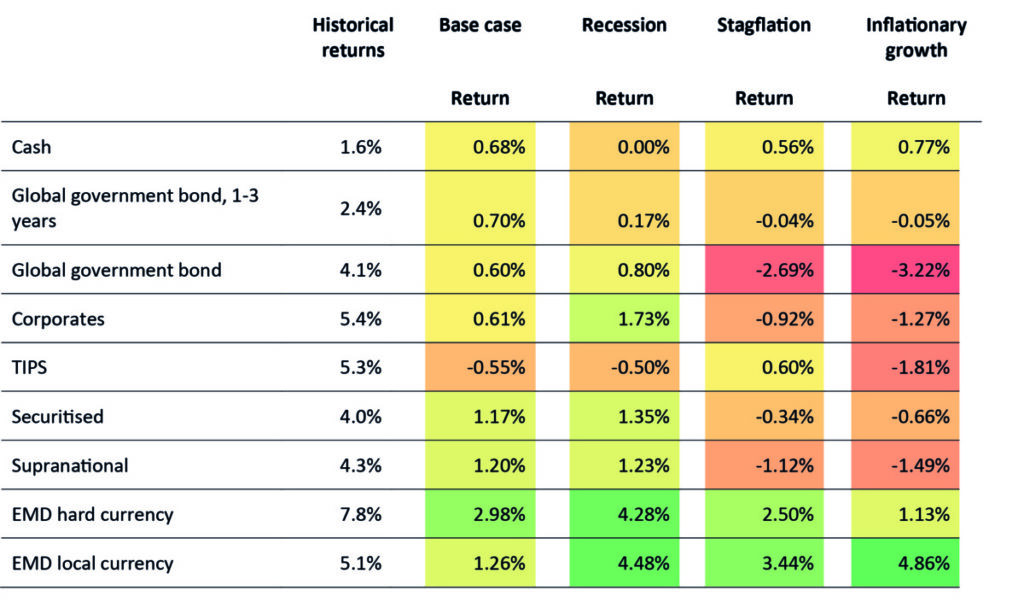

The losses experienced on the most liquid and low-volatility government bonds is a wake-up call for reserves managers. In the last 20 years, central banks have enjoyed strong returns on their reserves. Using a portfolio mix of select developed market government bonds, we estimate that short duration (one- to three-year) government bonds have generated a return of more than 2% on an annualised basis over the last two decades. A portfolio of longer-duration government bonds from these same markets has returned more than 4%.

Beyond government bonds, returns in investment-grade spread products have ranged between 4% for asset-backed securities on the lower end to nearly 8% for hard currency-denominated emerging market debt on the upper end (see table).

Table 1: Historical returns compared to expected returns under four potential scenarios

In the last 20 years, central banks have been able to fulfil the primary objectives of their mandate in reserves management – liquidity and capital protection – while enjoying an additional premium above the inflation rate. The attractive rates of return on government bonds have not only protected their purchasing power in real terms but have also played an important role as a diversifier from the exposure to equity markets for those central banks that have invested in this asset class.

In the last 20 years, central banks have been able to fulfil the primary objectives of their mandate in reserves management – liquidity and capital protection – while enjoying an additional premium above the inflation rate. The attractive rates of return on government bonds have not only protected their purchasing power in real terms but have also played an important role as a diversifier from the exposure to equity markets for those central banks that have invested in this asset class.

The ability of conventional fixed-income assets to serve the dual role of providing returns above inflation and diversification from equity risk will be tested going forward. For a portfolio of developed market government bonds, our base case is that over the next five years future returns could decline dramatically from a historical average of 2.4% for the short-duration portfolio and 4.1% for the longer-duration portfolio, to as low as 0.7% and 0.6%, respectively.

This assumes the current high bout of inflation is transitory and that interest rates will normalise over the next two to three years. In an environment of stagflation characterised by low growth, high inflation and high interest rates, our hypothetical portfolios fare even worse, as expected returns become negative across short- and long-duration bonds.

There are similar outcomes in an inflationary growth scenario. It is therefore not surprising that even shorter-duration, high-quality portfolios are in the red so far this year. At the individual asset class level, returns are also expected to be meaningfully lower on a forward-looking basis, even in spread sectors like investment-grade corporates and securitised assets.

Fixed-income investors are realising that, after almost three decades of a bull market in bonds, the road ahead will be more challenging. The combination of record low starting yields and rising interest rates, as central banks begin policy normalisation, make the starting point particularly difficult. These challenges are not insurmountable, however.

To bridge the gap between the current environment of meagre yields and low returns and a future state where yields are high enough to better cushion against losses, we believe investors need to move away from a siloed approach to fixed-income markets and embrace flexibility. This can be accomplished either by broadening their investable universe to include more countries, sectors and instruments, or by adopting more flexible fixed-income strategies that are actively managed across these different dimensions. The combination of expanded opportunities and diversification of return sources can play an important role in helping protect fixed-income portfolios.

Over the last two decades, central banks have made tremendous progress in how they manage reserves. A further step has to be taken now to adapt their investment strategies to the changed economic and financial conditions and to protect the value of their reserves.

Massimiliano Castelli is Managing Director and Head of Strategy and Advice for Official Institutions at UBS Asset Management.

The views expressed are as of January 2022 and are those of the author and not necessarily the views of UBS Asset Management. This article is a marketing communication and the information herein should not be considered investment advice or a recommendation to purchase or sell securities or any particular strategy or fund. Information and opinions have been provided in good faith and are subject to change without notice.