The gilt market will be pushed to its limit with significantly more supply set to enter the hands of private investors than ever before. After Chancellor of the Exchequer Jeremy Hunt unveiled the budget on 15 March, the UK Debt Management Office announced its borrowing remit for the 2023-24 financial year with £241.1bn of planned gross gilt sales.

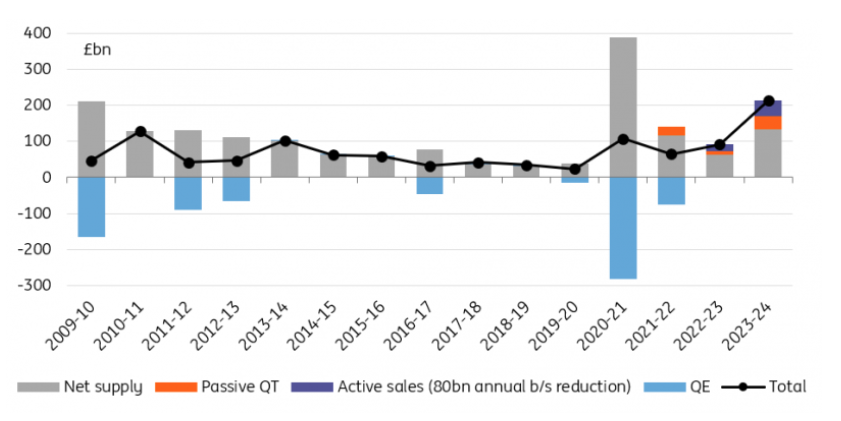

This will be a record amount of net gilt supply, taking into account the lack of quantitative easing and instead £80bn of quantitative tightening by the Bank of England during the financial year. The total net supply of gilts in the hands of private investors is set to reach £204bn, according to calculations by Antoine Bouvet, senior rates strategist at ING (Figure 1).

This figure is even higher than the projected total net gilt issuance of £116bn for the financial year following the infamous mini-budget presented by former Chancellor Kwasi Kwarteng on 23 September in response to the energy crisis. Kwarteng swiftly scrapped large parts of the proposed tax cuts and other measures in a U-turn that later led to his resignation along with Liz Truss, prime minister at the time. The DMO is expected to round off the financial year with around £98bn of net borrowing, according to Bouvet – less than half of next year’s total.

While gilt sales reached £485.8bn in 2020-21 at the height of the Covid-19 pandemic, £388bn of this was consumed by the BoE’s QE programme, leaving £97.5bn of net supply. Now, there is no QE and the BoE is selling its own stock of gilts.

Figure 1. Gilt supply to reach record levels in 2023-24

Source: ING, UK DMO, Bank of England

Source: ING, UK DMO, Bank of England

The increase in supply after the budget was expected by investors. This explains the largely muted reaction to gilt yields, which have been falling since the collapse of Silicon Valley Bank in a flight to safety from investors. The 10-year gilt opened with a yield of 3.53% on 15 March before dropping to as low as 3.27% on the same day.

To take down much more supply than they have ever before will ask a lot from private investors. ‘The good news is that this is a known issue so investors had time to prepare,’ said Bouvet. ‘I don’t expect major trouble, but this makes the gilt market more sensitive to stress. For instance, I expect liquidity to be more challenging in times of market volatility.’

The gilt market is known for its stability even in volatile markets but the record amount of supply may see this disturbed. This will also mean the UK DMO will require even more steady hands to navigate its auctions and syndications with the help of its primary dealer group, who will themselves be under pressure with their market-making obligations.

According to Imogen Bachra, head of UK rates strategy at NatWest Markets, gilt yields will be pushed much higher by the incoming supply. ‘I think it should put significant upward pressure on yields, as the usual sectors of demand – LDI at the long-end, overseas investors out to the belly of the curve – have been noticeably absent of late,’ she said. ‘The clearing price of all these gilts will have to gradually shift lower and lower for the market to be able to absorb them.’

Bachra and her team at NatWest Markets have set a 4.3% target for 10-year gilt yields by Q3 in response to the heavy supply outlook.

From the £241.1bn of gross gilt issuance, £202.1bn will be sold through 66 auctions, with £86.7bn pushed to the short end of the curve. The remaining £27bn of issuance will be raised through seven syndications, of which three will be in an index-linked format. The UK will raise £10bn in green format.

Bouvet said outweighing sales to the front of the curve will help investors absorb the supply. ‘Front-end supply has lower duration, and so lower interest rate risk,’ he said. ‘This means that, for a given amount of interest rate risk, an investor can absorb a greater nominal amount of debt.’

However, Bachra is less sure. ‘It may do, in the sense that demand is more likely to materialise more quickly from the natural buyers at that part of the curve,’ she said. ‘It also helps in reducing the overall duration that will be issued to the market. But we had expected a larger skew away from longs and linkers, so relative to our expectations it is not that helpful.’

Burhan Khadbai is Head of Content, Sovereign Debt Institute, OMFIF.