The Federal Open Market Committee meets for the first time in 2022 on 25-26 January. Its meeting comes at a critical time.

With headline consumer price index reaching 7% year-over-year – reflecting increases in a wide range of major categories – and unemployment moving below 4%, the Federal Reserve has made clear that controlling inflation is priority number one.

The US monetary policy outlook is shifting towards a tighter posture. The September 2021 FOMC dot plot pencilled in one rate hike in 2022. Now, the FOMC debate centres around three, if not four, Fed funds rate hikes in 2022, with increases starting in March. The FOMC already moved the end of tapering forward from mid-2022 to March and is now telegraphing its aim to move far more quickly on balance sheet reduction compared with the past.

One might have expected this shift in the Fed’s monetary policy outlook to reverberate throughout financial markets. But markets seem to be only slowly getting the message.

At his confirmation hearing, Fed Chair Jerome Powell underscored the ‘severe threat’ posed by inflation. That day, markets found his comments reassuring and less hawkish than expected, according to media reports. Stocks went up.

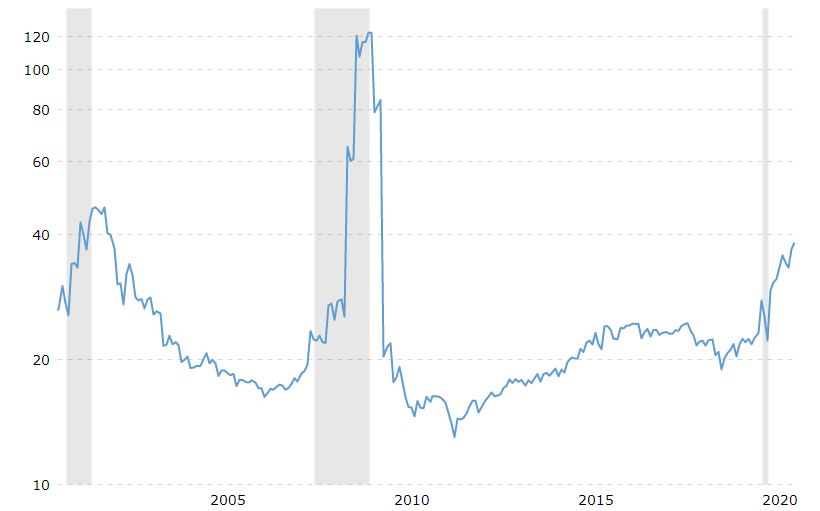

Financial conditions continue to highlight enormous US accommodation. Financial conditions indices haven’t budged much in recent months. The Goldman Sachs FCI remains around its all-time low. The Chicago Fed national conditions index tells a similar story (Figure 1).

Figure 1. Chicago Fed FCI remains low

Source: Federal Reserve Bank of Chicago

Source: Federal Reserve Bank of Chicago

Equities and rates heavily influence financial conditions. The S&P is up versus the September FOMC. To be sure, the monetary policy outlook has triggered some down days for the market, especially for the tech sector. Yet, equities remain richly valued – for example, the S&P 500 price/earnings ratio – and many analysts view asset valuations as stretched (Figure 2).

Figure 2. Equity prices are high and extended

Source: Macrotrends

Source: Macrotrends

Much attention has been focused on recent increases in 2- and 10-year Treasuries. But short-term rates remain extremely low. Three-month rates are little more than 10 basis points. In real terms, interest rates remain staggeringly low across the board.

Market measures of inflation expectations remain largely in check despite the CPI’s run-up, perhaps owing to perceived Fed credibility (Figure 3).

Figure 3. Inflation expectations rates remain low

Source: Federal Reserve Bank of St Louis

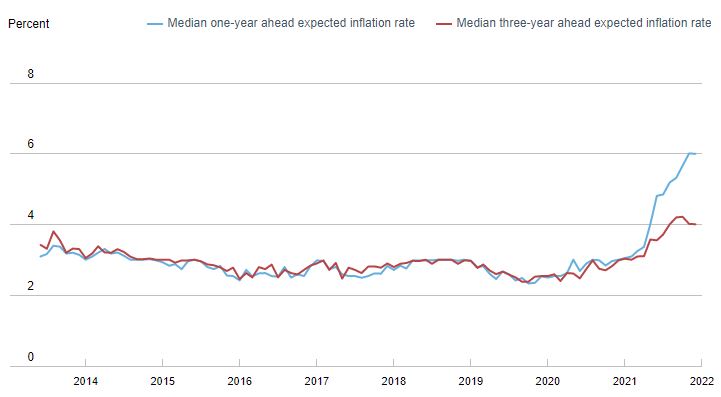

Yet, consumer survey expectations are less sanguine (Figure 4). Both they and market gauges are hardly infallible.

Figure 4. Consumers are less optimistic

Source: New York Fed Survey of Consumer Expectations

Source: New York Fed Survey of Consumer Expectations

Some measures of market expectations for the terminal Fed funds rate are around 1.75%. The December 2021 dot plot puts it at 2.5%. However, the Fed funds rate could well end up in the 3% to 4% range.

Dollar appreciation would tighten conditions. While some analysts argue the dollar may rise on the back of widening interest differentials favouring the US, a range-bound dollar is perhaps a more likely outcome.

Market participants have long comfortably relied on a perceived Fed ‘put’, giving them downside insurance and comfort in their risk-taking. The markets have gone from Alan Greenspan puts to Ben Bernanke puts to Powell puts.

Many forecasters see US inflation heading downwards over the course of the year, often towards 2.5% to 3% year-over-year by the fourth quarter of 2022. These projections may well prove right and perhaps a cautious Fed can make a soft landing.

Over the past decade, Fed communication with the market has improved, shaping and guiding expectations successfully with improved transparency and open mouth operations, while volatility remained low.

There will be much hand-wringing over US inflation and debates about balance sheet reduction at the January FOMC, but a move in the Fed funds rate is not likely to take place until March, nor are balance sheet decisions expected.

But the question marks around inflation dynamics, the continued highly accommodative financial conditions, stretched valuations and the extent to which markets are internalising the Fed’s evolving message seem inconsistent with the shift in the Fed’s rhetoric, the monetary policy outlook and possible upside risks to inflation. Thus, the FOMC’s communications at the January meeting, in the press statement and the press conference offer a critical opportunity for the Fed to improve messaging to markets, influence inflation expectations and reduce excessive laxity in financial conditions.

A communications jolt may be in order. It should be measured and handled with caution. The Fed would certainly not wish to risk triggering another 2013-style global taper tantrum or upset healthy US labour market dynamics with too strong a jolt. Nor can monetary policy fix supply chain woes. But a measured jolt could help better align financial markets and conditions with the Fed’s rhetoric and outlook, without triggering undue volatility.

While this is much easier said than done, the talented penmanship and wordsmithing of the excellent Fed staff scribes should easily be able to navigate such shoals.

Mark Sobel is US Chairman of OMFIF.