Brazilian economic outlook and challenges ahead

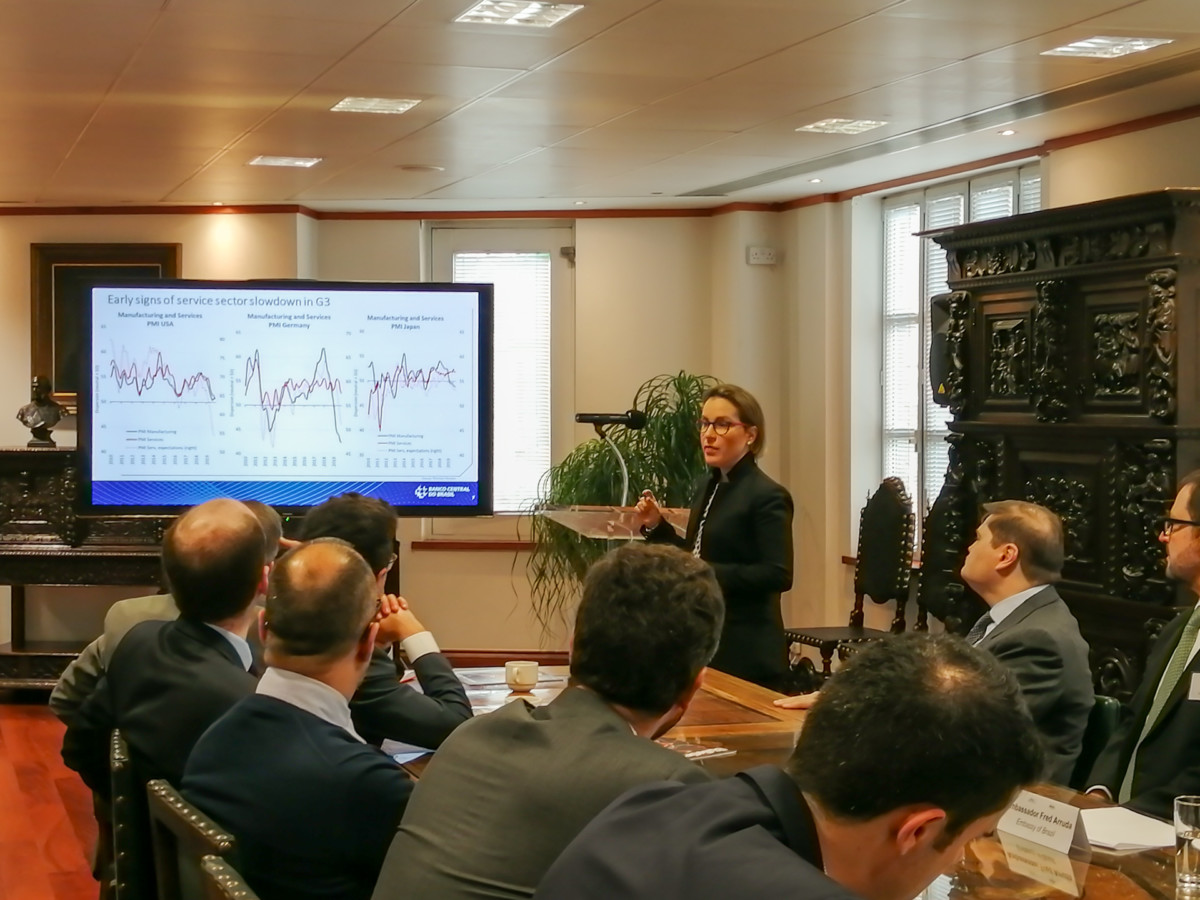

The global economic outlook is uncertain, the decline in manufacturing is starting to seep into services, and central bankers around the world are asking themselves how much space they have for monetary and fiscal policy. This was how Fernanda Nechio, deputy governor for international affairs at the Banco Central do Brasil, introduced her presentation on Brazil’s economic outlook at an OMFIF roundtable.

Brazil’s economy is closed and is therefore unlikely to be affected by trade tensions. However, it may be affected by financial conditions abroad.

The country is recovering gradually from its 2014-16 financial crisis, with the domestic economy expected to pick up in the near future. Growth is projected to be around 2% next year. The economy is expanding slowly, but this is positive, it was argued, because slow growth is healthier and more sustainable than the one-off spikes in growth that led to Brazil’s previous fiscal challenges. This growth, noted the deputy governor, is for the first time being driven by the private sector. At 5%, interest rates in Brazil are the lowest they have ever been. But this has caused uncertainty on macro sensitivity to stimulus.

Just over a year after Jair Bolsonaro was elected president, the government is introducing a raft of legislative changes. Nechio was confident that the sweeping pension reform approved by the senate last month would reduce significantly public debt. An overhaul of Brazilian fiscal policy is in the works.

The Brazilian central bank is developing an open banking initiative; while many Brazilians have a bank account, few have access to financial products.

It is ramping up its communications efforts and increasing dialogue with congress, after policy-makers admitted they had difficulty understanding monetary policy proposals. The central bank has also partnered with schools to enhance financial education.

The Banco Central do Brasil acts independently, but is not independent officially, and as such any measures it wishes to introduce require government approval. For now, congress and public opinion are in favour of the central bank’s proposals, but this environment could be clouded by the early release from prison of former President Luiz Inácio Lula da Silva, who before his incarceration was Bolsonaro’s main political rival.

Speaker:

Fernanda Nechio, Deputy Governor, Banco Central do Brasil