World falling out of love with globalisation

A shift in attitudes, geopolitical flare ups and resurfacing developments in the US have prompted nations to reconsider globalisation, despite its many benefits, writes Mark Sobel, US chairman, OMFIF.

Beware retaliatory protectionism

Without care, an unhelpful jigsaw piece from the 1930s might come crashing into place. By Neil Williams, chief economist, OMFIF.

The economic consequences of geopolitical conflict are more serious now than during the cold war, writes Meghnad Desai, chairman of OMFIF’s advisory council.

Finance and fragmentation

From globalisation to deglobalisation

Financial globalisation has held up pretty well so far, but will it succumb to fragmentation? By Massimiliano Castelli, head of strategy and advice, and Philipp Salman, strategy and advice, global sovereign markets, UBS Asset Management.

Will commodity-based currencies supplant Eurodollar?

Currencies usually enjoy a century of dominance, with the dollar gaining its status in 1944. That may be coming to an end, writes Willem Middelkoop, member of the OMFIF advisory board.

Global finance in the new geopolitical environment

The new paradigm in global politics will have a marked effect on financial transactions, writes Herbert Poenisch, senior research fellow, AIF Hangzhou.

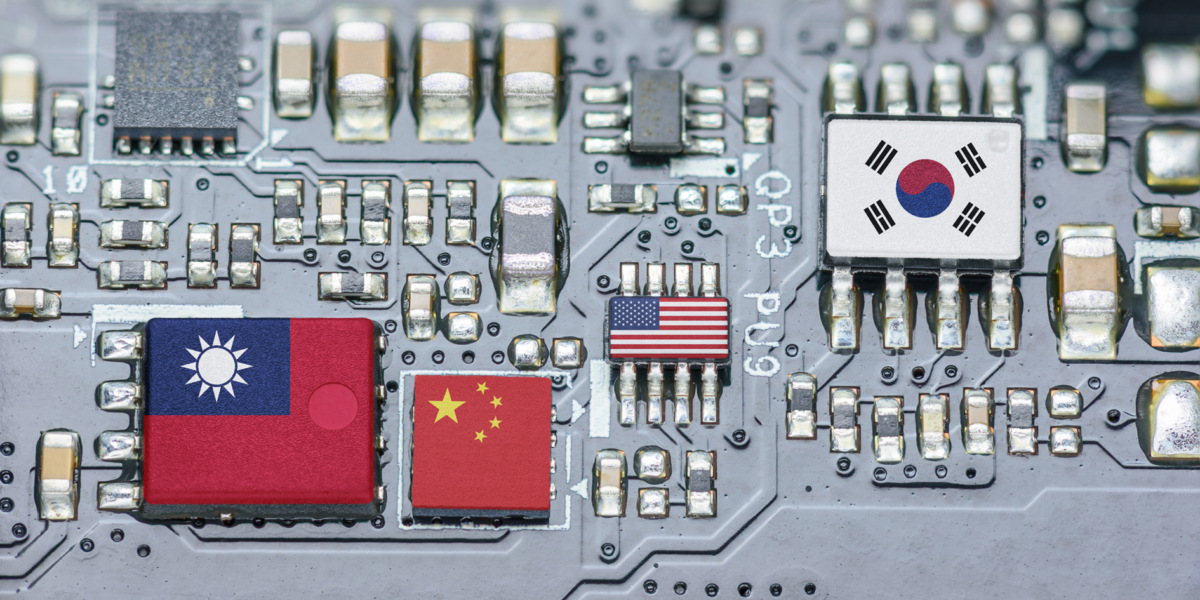

Trade and protectionism

The geopolitics of protectionism

Protectionism increases the cost of global trade, explains Elliot Hentov, head of policy research, State Street Global Advisors.

Asian economies adjust to growing tensions

Inclusion and sustainability are key to a resilient global trade system, by Roberta Casali, vice president, finance and risk management, Asian Development Bank.

Industrial policy and energy

Industrial policy: sounds good, but unsound

Investment in education, healthcare and climate change will do more to address inequality, explains Taimur Baig, chief economist, group research, DBS Bank.

Rethinking the euro area’s economic model

The economic model that served the euro area in the decade before the pandemic is no longer fit for purpose, writes Katharine Neiss, chief European economist at PGIM Fixed Income.

A global climate agenda for Europe

COP27 delivers an opportunity for Europe and Africa to lead on global climate action, writes Frank Scheidig, global head of senior executive banking, DZ BANK.

Regional spotlight: central and eastern Europe

Advancing EU’s open strategic autonomy best response to geopolitical challenges

More than a cold winter lies ahead for new EU members and the Balkans

Higher energy prices are forcing an economic readjustment for many central and eastern European states, writes Miroslav Singer, former governor of the Czech National Bank.

Regional spotlight: Latin America

The impact of war on Latin America and the Caribbean

To address the economic shockwaves of Russia’s invasion of Ukraine, a post-pandemic fiscal consolidation is necessary, writes Mauricio Cardenas, School of International and Public Affairs at Columbia University.

Don’t take resilience for granted

Latin American economies should not risk their hard-won monetary and fiscal credibility, writes Alexandre Tombini, chief representative of the Bank for International Settlements in the Americas.

Statist and protectionist policies are being embraced by a new generation of leaders, writes Kimberly Breier, senior adviser at Covington & Burling.

Financing Ukraine’s fight against Russia’s invasion

3 August 2022

Inflation, energy security and productivity: euro area’s monetary response

Inflation, energy security and productivity: euro area’s monetary response

26 August 2022

Prospects for emerging markets

Prospects for emerging markets

6 September 2022

Bank of England independence under Truss

Bank of England independence under Truss

22 September 2022

In conversation with Charles Evans: the future of the US economy

In conversation with Charles Evans: the future of the US economy

27 September 2022

What’s next for the Italian economy?

What’s next for the Italian economy?

10 October 2022