Autumn 2022

From globalisation to deglobalisation

Financial globalisation has held up pretty well so far, but will it succumb to geopolitical fragmentation? By Massimiliano Castelli, head of strategy and advice, and Philipp Salman, strategy and advice, global sovereign markets, UBS Asset Management.

The current slowdown in globalisation is not a new phenomenon. It is a trend that started around the time of the 2008 financial crisis and represented a break from the previous ‘hyper-globalisation’ phase that started in the late 1980s.

Trade growth has never been stronger relative to gross domestic product growth, as it was during the two decades before the financial crisis. It could not have been otherwise if you consider the events of this period: from the advent of the internet to the fall of the Berlin Wall and the entry of China into the World Trade Organization.

Since the financial crisis, global trade in goods and services has flattened when measured in terms of percentage of GDP. In other words, global trade now grows more in line with economic growth, so the trade intensity of GDP has fallen.

Why has this happened? We believe that beyond trade protectionism there are important structural trends at play: the shift from tangible to intangible goods both in terms of consumption and investment, the shift from goods and commodities to services, as well as technological developments. For example, instead of shipping CDs and DVDs produced in Asia around the globe, music is mostly consumed as a streaming service these days. All these trends reduce the need for moving manufactured goods across borders. This is also shown by the fact that there was no significant slowdown in global service trade.

Trade protectionism under the Donald Trump administration and rising China-US confrontation further reinforced this trend, but it would be erroneous to believe that there are no other drivers. This also means that a potential relaxation of trade tensions with China, as indicated by the announcement by President Joe Biden’s administration of tariffs on Chinese exports, does not necessarily mean that trade growth will accelerate towards the levels experienced before the financial crisis.

We are experiencing a slowdown in globalisation from a period of exceptional growth that reached its peak in 2008, driven by a host of factors that appear to be more structural than political. Therefore, the current period could resemble more the 1970s and early 1980s when globalisation flattened, rather than the deglobalisation phase of the interwar period. Of course, the war in Ukraine is likely to provide further impetus to this slowdown – particularly with regard to financial globalisation – but the magnitude of the impact remains dependent on how the geopolitical situation will develop in the future.

Financial globalisation has held up well, so far

Financial globalisation is the pillar of globalisation that has suffered the least since the 2008 financial crisis. It is true that financial globalisation – measured in terms of global cross-border financial flows – reached a peak in 2008 and has never reached that level since. This was largely due to the drop in cross-border bank lending, particularly within Europe, as banks retreated from international expansion and adapted to the more stringent regulatory environment. However, cross-border financial flows – including portfolio flows and foreign direct investment – recovered quickly from the financial crisis and have remained at high levels from a historical perspective.

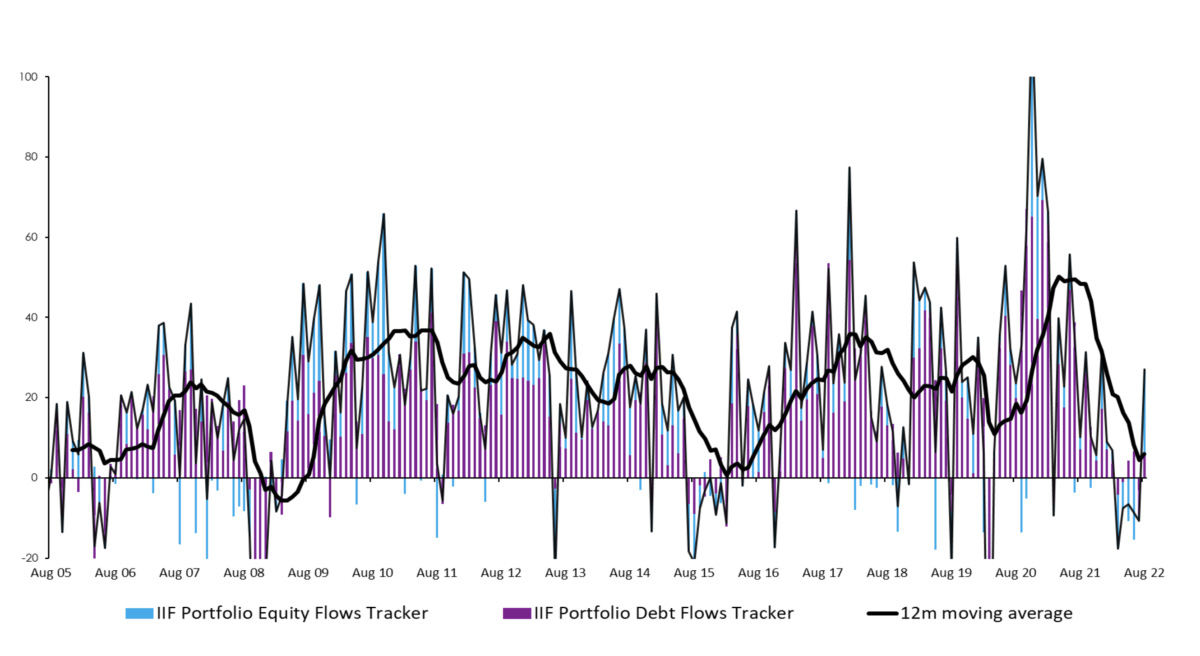

In 2021, following the Covid-19-related slump, both portfolio and FDI flows recovered to pre-pandemic levels. However, in 2022, as the war in Ukraine erupted and interest rates started to rise, foreign investments into emerging markets slowed down sharply. FDIs started to fall as international corporations became more cautious amid economic uncertainty and geopolitical tensions. While cyclical factors play a role, and we expect flows will eventually resume as soon as uncertainty eventually abates, there is also growing evidence of a reorientation of flows towards advanced economies (Figure 1).

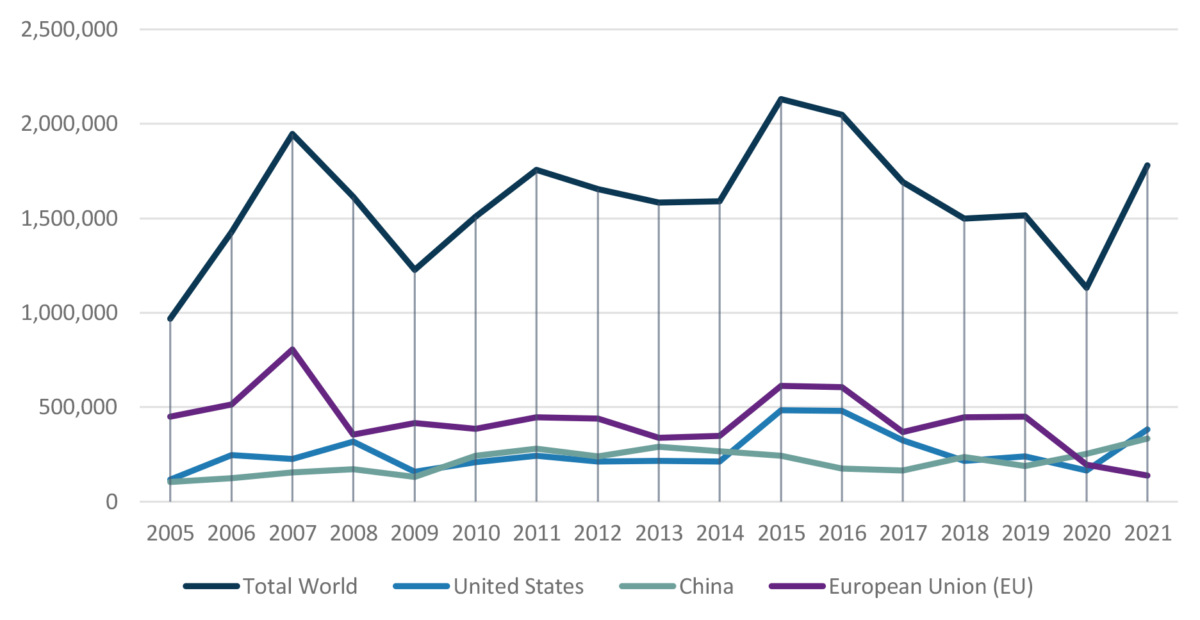

Of particular interest is China, which has been a large receiver of FDIs over the last two decades as it was gradually opening up its domestic capital markets. Data available for 2022 year-to-date show that foreign flows into China are going up, mainly due to flows from Hong Kong and offshore financial centres, which could also originate from the financial operations of mainland companies (Figure 2). The fact that most of these flows are going into the service sector instead of manufacturing could reflect adjustments in international value chains, as multinationals diversify across a broader set of countries driven by uncertainty over the Chinese economy and rising geopolitical tensions. However, when it comes to the net effects on financial globalisation, this could instead show a reorientation of investment flows towards other countries in the Asia Pacific region and does not necessarily signal a net slowdown.

Figure 1. Portfolio flows reorientated towards emerging markets

$bn

Source: Institute of International Finance

Figure 2. FDI flows into China are increasing

$m

Source: IIF

Weaponisation of finance: the impact of sanctions

Geopolitical tensions have led to rising protectionism in foreign investments. The number of countries increasing scrutiny or raising defences against foreign investments, particularly in sensitive sectors such as technology and more recently energy, has increased sharply. The war in Ukraine has also led to unprecedented new escalations when it comes to financial sanctions, with the exclusion of Russian financial institutions from the Swift network and the targeting of reserves held by sovereign institutions.

The annual UBS Reserve Management Seminar Survey conducted in June 2022 provided some context for the potential implications of these sanctions. According to 50% of surveyed participants, the sanctions against the Central Bank of Russia mean that, while foreign exchange reserves will remain important, they might have to be managed differently going forward. In contrast, 10% expected a significant impact; for them, the role of FX reserves would be impaired given the sanction risk and alternatives might have to be considered by a growing number of central banks.

Crucially, when asked whether larger central banks could be affected by sanctions comparable in severity to those imposed on the Russian central bank over the coming years, 27% of respondents thought this could be the case, while 73% did not think that it is likely to happen. When asked about currencies, 63% see limited or no impact for the dollar, which will remain the dominant currency, while 38% expect some impact, including an acceleration of the decline of the dollar’s share in global reserves. With regard to the renminbi, 60% expect little or no impact, and a further 40% expect some impact, for example, in the form of an accelerated rise in the share of renminbi in global reserves. When asked which reserves currencies are likely to benefit the most in the long term from a shift towards a more multipolar world following recent events, 81% think that the renminbi will benefit, and 46% the dollar.

But should the relevance of central bank reserves decline slightly, what could participants see emerging as alternatives? Survey respondents mentioned swap agreements with friendly central banks (59%), digital currencies (41%) and gold or commodity-based currency systems (48%). Finally, while 64% of participants think that recent events will accelerate the adoption of central bank digital currencies globally, only 15% of respondents indicated that private cryptocurrency projects (like bitcoin and ethereum), or private stablecoins (like Tether) are likely to benefit from a shift towards a multipolar world.

The shift towards a multipolar financial system has already started

The phase of hyper-globalisation was very much based on the free movement of goods and capital and the global financial architecture was largely centred around the dollar. In trade, there are already growing signs of deglobalisation with international trade stagnating. The reconfiguration of international value chains has just started, and it is reasonable to expect that this will provide further impetus to this trend in the future.

So far, the free movement of capital has held up better than trade, as Chinese and other emerging markets’ financial markets continue to be integrated into global markets. But unusually high uncertainty with regard to inflation and interest rates are having a negative impact on global financial flows – particularly in emerging markets – as investors are targeting better risk-adjusted returns in advanced economies. However, this is largely a cyclical effect likely to be reversed once uncertainty eventually declines.

Nevertheless, there are growing signs that the reconfiguration of international value chains, ‘friendly’ onshoring and rising geopolitical tensions are having an impact on global financial flows. This is particularly true for FDIs, which are very much linked to the investment decisions of international corporations, are less volatile and tend to follow longer cycles. However, there has been a plateauing in global flows and a reorientation across emerging and advanced economies.

The rise of China and other emerging markets has only slightly altered that architecture, as shown by the slow fall of the dollar in global reserves and the slow rise of the renminbi. Deglobalisation is often seen as a departure from the dollar-based system, as geopolitical fragmentation could lead to more competition against the dollar. However, there has not been any significant shift in this direction so far and, to a certain extent, the shift towards a multipolar global financial architecture was already happening before the recent events surrounding Russia.

When it comes to financial globalisation, recent geopolitical developments are likely to have an impact, but where all this will lead is still uncertain. In line with the gradual shift to a multipolar system, more regional and fragmented capital will continue flowing across borders, but at a more muted pace. This is a relatively benign scenario that assumes that geopolitical tensions do not further escalate. A more negative scenario is one of further escalation in the relations between the West and the rest of the world, particularly with regard to the relationship between China and the US. In such a scenario, financial globalisation is heavily impacted with a more widespread use of sanctions as a geopolitical weapon.

The views expressed are as of October 2022 and are those of the author and not necessarily the views of UBS Asset Management. This article is a marketing communication and the information herein should not be considered investment advice or a recommendation to purchase or sell securities or any particular strategy or fund. Information and opinions have been provided in good faith and are subject to change without notice.