OMFIF’s Global Public Investor 2023 report goes further than ever before to unpack reserve managers’ economic views, investment plans and internal operations. The latest edition features insights from a survey of 75 central banks with international reserves of close to $5tn.

OMFIF first launched the Global Public Investor in 2014 to recognise the importance and influence in global financial markets of the world’s biggest public funds, with a particular focus on central bank reserve managers. In the 10 years of the publication, the role of reserve managers is not getting any easier.

We estimate that total foreign exchange reserves have dropped by 5%, equating to losses of almost $725bn, since their peak in late 2021. Among our survey sample, 80% suffered portfolio losses last year as inflation and rising interest rates hit their fixed income investments.

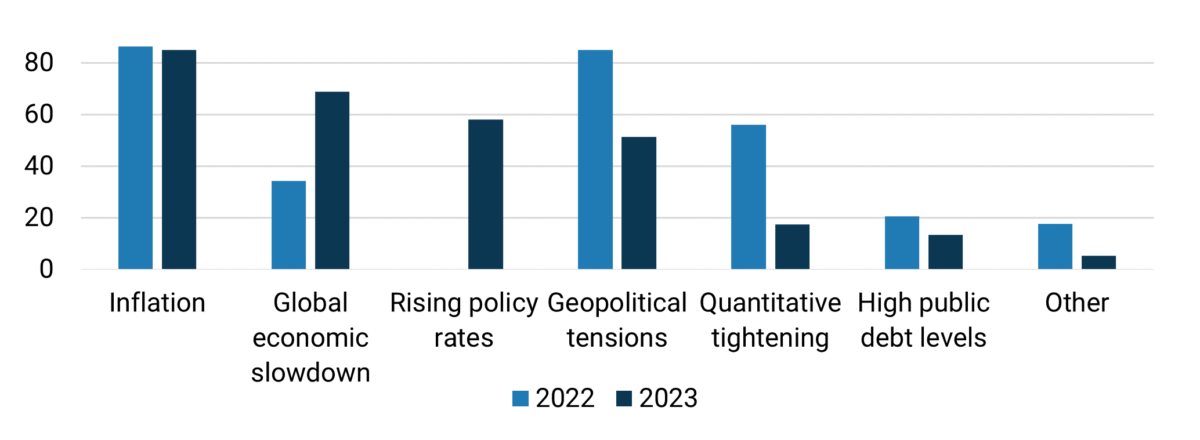

As was the case a year ago, reserve managers have little confidence that their colleagues in monetary policy committees will get inflation under control. Inflation is one of the three biggest near-term economic concerns for 85% of respondents – broadly unchanged from a year ago. And not a single respondent expects inflation to fall to target in major economies in the next 12-24 months.

It’s not simply inflation but stagflation that’s the key concern this year. Almost 70% count a global economic slowdown among their top three concerns – over twice the share from 2022. And 38% expect a global economic recession in the next 12 months. Accordingly, there is low optimism that there will be a soft landing.

Stagflation concerns growing

What are the three most important economic challenges affecting your investment approach over the next 12-24 months? Share of respondents, %

Source: OMFIF GPI survey 2022-23

*Note: Rising policy rates not included as an option in 2022.

Amid the difficult economic backdrop, traditional reserve assets are seeing renewed demand. A net 32% of respondents plan to increase their allocation to conventional government bonds and 20% to quasi-government bonds in the next two years. Higher yields seem to be drawing in reserve managers to fixed income. It’s also a reflection of an intended flight to safer assets, consistent with the finding that gold is the asset with the third-highest net demand.

Traditional reserve assets most in demand

Over the next 12-24 months do you expect to increase, reduce or maintain your allocation to the following asset classes? Share of respondents, %

Source: OMFIF GPI survey 2023

Another important consideration for reserve managers is geopolitics. This factor was considered the number one factor affecting reserve management in the next five to 10 years and 83% listed it in their top three. Several survey participants mentioned US-China tensions and the possible fragmentation of trade and capital flows as a source of concern.

This issue will probably have a major bearing on their dollar and renminbi holdings in the years to come. At this stage, central banks don’t expect the greenback to be toppled as the dominant reserve currency though its influence is likely to wane. The majority of survey respondents anticipate that the dollar’s share of global reserves will gradually fall to 54% in the next decade, from just under 60% now.

One survey respondent summed up this trend by stating ‘although US dollar will remain as the main reserve currency, its importance is going to diminish gradually with the rise of alternative reserve currencies such as renminbi.’ Close to 40% of central banks plan to increase their holdings of renminbi over the next 10 years – higher demand than for any other currency. A net 9% of central banks expect to increase their euro holdings over the next 10 years too, suggesting it may also play a key role in diversification strategies away from the dollar in the medium to long term.

Renminbi key to long-term diversification

Over the next 10 years, do you anticipate increasing, reducing or maintaining your exposure to the following currencies? Share of respondents, %

On top of these important economic and geopolitical considerations, we also explore the need for reserve managers face in improving their use of data and technology, and building their investments in sustainable assets, and they difficulties they face in doing so. One underlying message that emerges is that central bank reserve managers are under pressure on multiple fronts. Navigating these challenges will be crucial to ensure that can provide a safety net to their economies in the years to come.

On top of these important economic and geopolitical considerations, we also explore the need for reserve managers face in improving their use of data and technology, and building their investments in sustainable assets, and they difficulties they face in doing so. One underlying message that emerges is that central bank reserve managers are under pressure on multiple fronts. Navigating these challenges will be crucial to ensure that can provide a safety net to their economies in the years to come.

Nikhil Sanghani is Managing Director of Research at OMFIF.