A central theme in OMFIF’s 2022 research has been the race between technological growth and adoption. This is particularly true with respect to the data management and processing systems that allow for increased efficiencies in financial institutions. This year, OMFIF studied the efforts of a diverse array of financial organisations to bolster their data processing. Our findings present a picture of the financial system in which several high-capital private institutions are leaders in improving their data systems, while others fall behind. Meanwhile, public institutions are caught in a conundrum of how best to reconcile the considerable costs and security concerns around the diffusion of such data.

Early in 2022, a key theme in OMFIF’s Global Public Investor 2022 was the significance of improved data access. In the GPI, over 70 central bank reserves manager survey respondents told OMFIF that a key barrier to accessing new asset classes was knowledge of that particular asset. The presence of such a barrier was especially pronounced when central bank reserves managers were asked about environmental, social and governance adoption. A majority mentioned that insufficient data was a barrier to implementing ESG initiatives. This suggests that both improved access to ESG data — and in many cases improved tools to process that data — would help many central banks efforts to embrace sustainability goals.

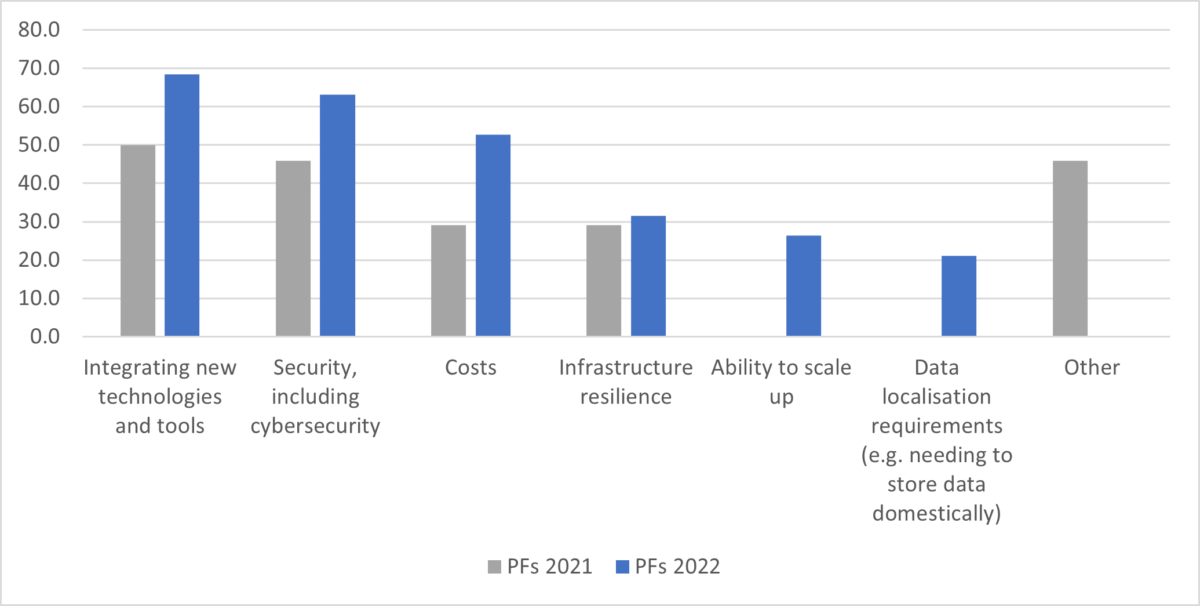

We continued to look at the hurdles financial institutions face with respect to their data management in the case of public funds. In the ‘Global Public Pensions’ report, over 80% of public funds that responded to our survey sought to build or improve their data management systems. Yet, 70% cited issues around integrating new technologies into their existing infrastructure and a growing majority mentioned cybersecurity and costs as barriers. Such challenges were present, for instance, with respect to cloud-based storage systems, which can be much more efficient but are more exposed to threats.

Data integration, cybersecurity and costs key barriers to using new technologies

What are your top technology challenges? Share of respondents, %

Source: Global Public Pensions 2022 and 2021

Another key theme has been the role that developing countries in the global south have played in spearheading the implementation of many modern data systems and digital tools, such as cryptocurrencies. Our research shows that many of them are also working to improve the digitalisation of their financial system more generally. This was a theme in the ‘Africa Financial Markets’ report, which underscored the considerable efforts many African countries were going to in order to bolster their processing of digital financial data. Egypt was notable for making a particularly large step in developing its data capacity and working to create a fintech hub. Meanwhile, Uganda formulated a five-year plan, which included additional support for big data, artificial intelligence and machine learning.

In the ‘Digital assets’ report, OMFIF studied the diffusion of digital assets and the possible emergence of central bank digital currencies in a growing number of countries. As that report covered, if such efforts are successful, it would significantly bolster government access to data on transactions occurring in the economy. This brings with it the prospect of expanded oversight into market operations, posing both benefits to warding against illicit activity as well as risks of overreach. Similar considerations around improving data access and processing emerged in the ‘Future of payments’ report. Here central bank survey respondents expressed a need to reconcile the cybersecurity and exchange rate volatility risks of digital payments systems alongside the clear benefits for cross-border payments.

So how is the financial system grappling with digitalisation and the increased need for improved data management practices? Our findings from this year’s reports suggest that many public institutions are doing so with caution. They simultaneously are striving to bolster their management systems while warding against the cybersecurity challenges that can erode value. In 2023, financial institutions will continue to embrace digital payments systems and data management tools.

Julian Jacobs is Economist at OMFIF.