DMI symposium On Demand

The global annual DMI symposium

10-11 May 2023

On 10-11 May 2023, the symposium returned to examine the distribution and use cases of both retail and wholesale central bank digital currencies, tokenised assets, deposits and capital markets, cross-border payments and domestic interoperability. Speakers explored regulatory framework harmonisation, cybersecurity considerations and the future of money in the metaverse.

This hybrid event was held in London, convening a global network of key policy-makers, regulators and public and private sector stakeholders. The symposium included public sessions attended by digital finance experts from across our community, and off-record, high-level roundtables to examine critical questions of technology applications, including cybersecurity and digital IDs. The agenda enabled participants to have their voices heard on important issues and move the industry beyond words into action.

Day one

Opening keynote and Q&A

Speakers:

Andrew Griffith MP, Economic Secretary, HM Treasury

Moderator:

John Orchard, CEO, OMFIF

Session I: Implementing and designing a retail CBDC: lessons and key insights

Building cross-border interoperability into retail CBDC• Balancing the trade-off between privacy and preventing financial crime

• Methods of tackling financial inclusion

• CBDC distribution and issuance models

• Incentivising commercial banks and merchants

Speakers:

Norhana Endut, Assistant Governor, Bank Negara Malaysia

Renato Gomes, Deputy Governor, Banco Central do Brasil

Tanja Heßdörfer, Director/Head of Sales, Business Development CBDC, Giesecke+Devrient

Moderator:

John Orchard, CEO, OMFIF

Session II: Stablecoins, CBDCs and tokens and the role of public and private money - the European perspective

• The growing role of fintech and the unbundling of financial services

• How to balance innovation and competition with stability and efficiency

• Assessing the impact of new technologies, stablecoins and tokens on retail and

wholesale payments

• The digital euro and EU’s technological competitiveness

Speakers:

– Piero Cipollone, Deputy Governor, Banca d’Italia

– Doris Dietze, Head of Digital Finance, Payments and Cybersecurity, Federal Ministry of

Finance, Germany

– Anikó Szombati, Chief Digital Officer, Magyar Nemzeti Bank

– Basak Toprak, EMEA Head of Coin Systems and Global Product Owner Deposit Tokens, Onyx

by J.P. Morgan

Moderator:

Philip Middleton, Chairman, Digital Monetary Institute, OMFIF

In conversation and Q&A: Project Icebreaker - a new architecture for cross-border retail CBDCs

Speaker:

– Andrew Abir, Deputy Governor, Bank of Israel

Moderator:

– Katie-Ann Wilson, Managing Director, Digital Monetary Institute, OMFIF

Presentation and Q&A: Bridging economies through a common multi-CBDC infrastructure

Speaker:

Mu Changchun, Director-General, Digital Currency Institute, People’s Bank of China (virtual)

Moderator:

John Orchard, CEO, OMFIF

Session III: Can blockchain revolutionise payments?

• Does blockchain offer superior efficiency, finality and security in the settlement process when compared to centralised architectures?

• Is programmability deliverable only in the context of a blockchain-based payments system?

• Does the removal of the single point of failure enabled by blockchain substantially contribute to systemic resilience?

• Does the transparency of blockchain holdings and payment records represent a challenge to privacy?

Speakers:

– Christian Catalini, Founder, MIT Cryptoeconomics Lab, Research Associate, MIT (virtual)

– David Creer, Global Digital Assets and CBDC Lead, GFT Group

– Scott Hendry, Senior Special Director, Financial Technology, Bank of Canada

– Knut Sandal, Director, Payments Analysis and Innovation, Norges Bank

Moderator:

Lewis McLellan, Editor, Digital Monetary Institute, OMFIF

Presentation and Q&A: Unlocking the potential of tokenised deposits

Speaker:

– Basak Toprak, EMEA Head of Coin Systems and Global Product Owner Deposit Tokens, Onyx

by J.P. Morgan

Moderator:

– Lewis McLellan, Editor, Digital Monetary Institute, OMFIF

Session IV: Next steps for cross-border payments: CBDCs, instant payments and upgrading existing infrastructure

• Are the efforts of the BIS, CPMI and principal actors in payments helping to improve

cross-border payments? Are we making progress?

• Is connecting CBDCs a viable means of improving cross-border payments? Is it likely

to produce a better result than connecting instant payments systems?

• Harmonising international standards and the next phase of the G20 roadmap – how

to achieve the FSB’s priority themes?

Speakers:

– Victoria Cumings, Chief Legal & Regulatory Officer, RTGS Global Limited

– Tommaso Mancini-Griffoli, Deputy Division Chief Monetary and Capital Markets, International Monetary Fund (IMF)

– Harvesh Seegolam, Governor, Bank of Mauritius

– James Wallis, Vice President, Ripple

Keynote address and Q&A: Money: A Question of Purpose and Trust

Speaker:

– Carolyn Wilkins, External member of the Financial Policy Committee, Bank of England

Moderator:

– Philip Middleton, Chairman, Digital Monetary Institute, OMFIF

Day two

Opening keynote and Q&A: Digital currencies: Identifying the guard rails for responsible innovation in payments

Speaker:

José Manuel Campa, Chairman, European Banking Authority

Moderator:

Guy Johnson, Anchor, Bloomberg

Session V: Asset tokenisation and wholesale CBDC: new plumbing in capital markets

• What benefits does representing ownership of securities using distributed ledger technology and blockchain bring and what new functionality can blockchain-based securities offer?

• Are regulators confident that blockchain can offer sufficient privacy, scalability and robustness for institutional capital markets?

• Is wholesale CBDC the appropriate method of settling the cash leg of securities transactions? Could a private sector solution fulfil the same role?

Speakers:

– Amar Amlani, Executive Director, Head of EMEA Digital Assets, Goldman Sachs

– Claudine Hurman, Director of Infrastructures, Innovation and Payments, Banque De France

– Benjamin Müller, Banking Operations, Swiss National Bank

– Monica Sah, Financial Regulation Partner, Clifford Chance

Moderator:

Lewis McLellan, Editor, Digital Monetary Institute, OMFIF

In conversation with Hester Peirce, Commissioner, US Securities and Exchange Commission

Session VI: Regulating risks and opportunities: a global crypto landscape

• What is the regulatory challenge posed by the borderless nature of digital asset transactions?

• Would current regulatory models have prevented the collapse of FTX?

• What new business models might be enabled by a new ‘token economy’ infrastructure?

• What is the appropriate way to treat cryptocurrencies on balance sheets when used as reserves or collateral?

Speakers:

– Moad Fahmi, Senior Adviser, Fintech, The Bermuda Monetary Authority

– Susan Friedman, Senior Director, Global Policy, Ripple

– Hester Peirce, Commissioner, US Securities and Exchange Commission

– Archie Ravishankar, Founder and CEO, Cogni

Moderator:

Philip Middleton, Chairman, Digital Monetary Institute, OMFIF

In conversation and Q&A: Getting ready for regulatory change -- MiCA and what’s next?

Speakers:

– Ivan Keller, Policy Officer, European Commission

– Brian Whitehurst, Head of Regulatory Affairs and Regulatory Counsel, Lukka

Moderator:

Julian Jacobs, Senior Economist, OMFIF

Session VII: How to ensure cybersecurity and privacy when developing a CBDC

Session VII: How to ensure cybersecurity and privacy when developing a CBDC

• Managing cybersecurity safeguards to ensure operational resiliency

• Frameworks and technical tools for different privacy models

• Infrastructure risk analysis for data protection and secure offline transactions

Speakers:

– David Birch, author, adviser, commentator on digital financial services and member of OMFIF’s DMI Advisory Board

– Jan Evangelista, Payments Policy and Development, Bangko Sentral ng Pilipinas

– Majid Malaika, Senior Adviser to H.E. The Vice Governor, Saudi Central Bank (virtual)

– David Schatzman, Principal GTM Mgr, Amazon Web Services*

Moderator:

– Nikhil Sanghani, Managing Director, Research, OMFIF

Presentation and Q&A: Behind the London CBDC scene: What is being tested?

Speaker:

Francesca Hopwood Road, Head of the BIS Innovation Centre London, Bank for International Settlements

Moderator:

Taylor Pearce, Senior Economist, OMFIF

Presentation and Q&A: Project mBridge – observing a common multi-CBDC platform

Speaker:

Thammarak Moenjak, Senior Adviser for CBDC Projects, Bank of Thailand

Moderator:

Taylor Pearce, Senior Economist, OMFIF

In conversation and Q&A: Does artificial intelligence and deep learning technologies stand to disrupt existing markets?

• What applications does AI present for central banking, including forecasting and supervising their economies?

• What are the potential risks posed by AI proliferation?

• How can public and private collaboration mitigate these risks, both economic and otherwise?

Speaker:

Maury Shenk, Founder and CEO, LearnerShape

Moderator:

Julian Jacobs, Senior Economist, OMFIF

Session VIII: DeFi: Navigating a new ecosystem

• DeFi has become a well-known term but the boundaries are not well established. How do we define this new space?

• For what use cases does DeFi add value and where will centralisation remain preferable?

• How can decentralised autonomous organisation platforms be made sufficiently accountable to regulators?

• What is missing from the DeFi ecosystem to make it adequately robust for widespread retail and institutional adoption?

Speakers:

– Martin Diehl, Head, Section Payment Systems Analysis, Deutsche Bundesbank (virtual)

– Charles Kerrigan, Partner, CMS

– Laura Loh, Director of Blockchain, Temasek (virtual)

– Timothy Massad, Director of the Digital Assets Policy Project, Harvard Kennedy School, Former Chairman of the Commodity Futures Trading Commission

Moderator:

Lewis McLellan, Editor, Digital Monetary Institute, OMFIF

Report: European Crypto Regulation: A Summary of Law by Country

EVENT AT A GLANCE

- Two-day symposium – join in-person in London, or virtually from around the world

- 40+ speakers from OMFIF’s global community of public and private sector representatives

- 150 in-person attendees, 2000+ virtual attendees drawn from central banks, institutional investors, banks and technology providers

- Public panels and presentations

- Exhibition stand area; open forums; bilateral meetings

- Private dinner 9 May in London with policy-makers for superior DMI members

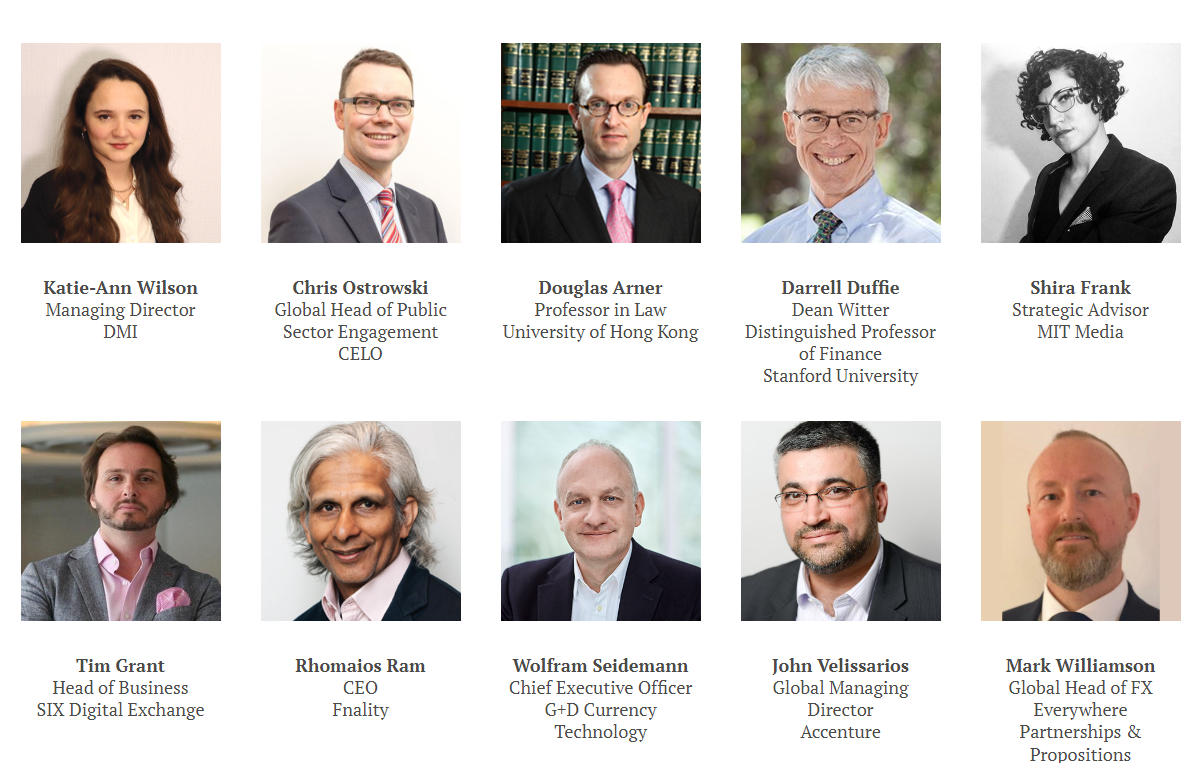

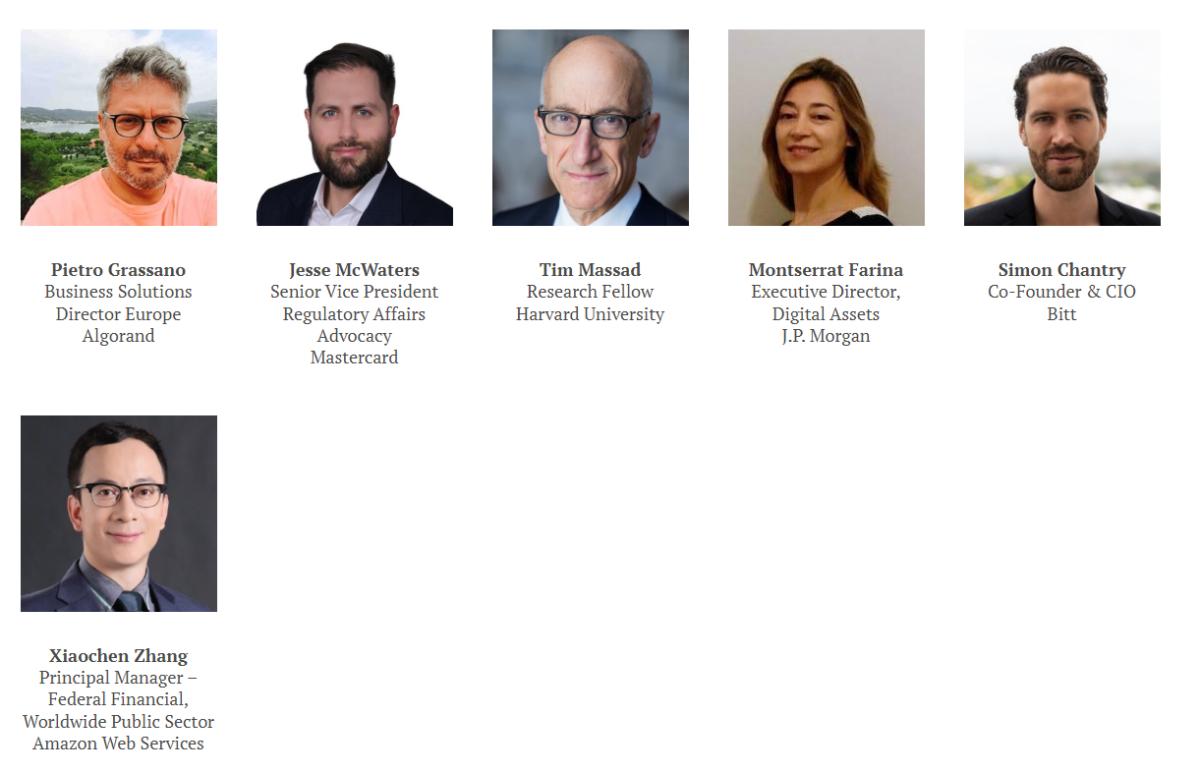

SPEAKERS

Andrew Abir

Deputy Governor

Bank of Israel

Dr. Ernest Addison

H.E. Governor

Bank of Ghana

Amar Amlani

Executive Director

Head of EMEA Digital Assets

Goldman Sachs

David Birch

Author, adviser, commentator on digital financial services

and member of OMFIF’s DMI Advisory Board

Christian Catalini

Founder

MIT Cryptoeconomics Lab

Research Associate

MIT

Jose Manuel Campa

Chairman

European Banking Authority

Mu Changchun

Director-General

People’s Bank of China

Piero Cipollone

Deputy Governor

Banca d’Italia

David Creer

Global Digital Assets and CBDC Lead

GFT Group

Victoria Cumings

Chief Legal & Regulatory Officer

RTGS Global Limited

Martin Diehl

Head of Section Payment Systems Analysis

Deutsche Bundesbank

Doris Dietze

Head of Digital Finance

Payments and Cybersecurity

Federal Ministry of Finance

Germany

Norhana Endut

Assistant Governor

Bank Negara Malaysia

Jan Evangelista

Payments Policy and Development

Bangko Sentral ng Pilipinas

Moad Fahmi

Senior Advisor Fintech

The Bermuda Monetary Authority

Susan Friedman

Senior Director

Global Policy

Ripple

Andrew Griffith MP

Economic Secretary

HM Treasury

Renato Gomes

Deputy Governor

Banco Central do Brasil

Tanja Heßdörfer

Director/ Head of Sales

Business Development CBDC

Giesecke+Devrient

Scott Hendry

Senior Special Director

Financial Technology

Bank of Canada

Francesca Hopwood Road

Head of the BIS Innovation Centre London

Bank for International Settlements

Claudine Hurman

Director of Infrastructures

Innovation and Payments

Banque de France

Ivan Keller

Policy Officer

European Commission

Charles Kerrigan

Partner

CMS

Laura Loh

Director of Blockchain

Temasek

Majid Malaika

Senior Advisor to H.E. The Vice Governor

Saudi Central Bank

Tommaso Mancini-Griffoli

Deputy Division Chief Monetary and Capital Markets

International Monetary Fund (IMF)

Timothy Massad

Director of the Digital Assets Policy Project

Harvard Kennedy School

Former Chairman of the Commodity Futures Trading Commission

Thammarak Moenjak

Senior Advisor for CBDC Projects

Bank of Thailand

Benjamin Müller

Banking Operations

Swiss National Bank

Hester Peirce

Commissioner

US Securities and Exchange Commission

Anastasia Raissis

Director, International Financials

Worldwide Public Sector

Amazon Web Services

Archie Ravishankar

Founder and CEO

Cogni

Monica Sah

Partner

Clifford Chance

Knut Sandal

Director

Payments analysis and innovation

Norges Bank

Harvesh Kumar Seegolam

Governor

Bank of Mauritius

Maury Shenk

Founder and CEO

LearnerShape

Anikó Szombati

Chief Digital Officer

Magyar Nemzeti Bank

Basak Toprak

EMEA Head of Coin Systems, and

Global Product Owner Deposit Tokens

Onyx by J.P. Morgan

James Wallis

Vice President

Central Bank Engagements

Ripple

Carolyn Wilkins

External member of the Financial Policy Committee

Bank of England

Brian Whitehurst

Head of Regulatory Affairs and Regulatory Counsel

Lukka

THEMES

Central bank digital currencies

Crypto assets and stable coins

Cross-border payments

Distributed ledger technology (DLT) and banking

Tokenisation of capital markets

BECOME A PARTNER IN 2024

OMFIF’s DMI symposium returns on 15016 May 2024 as the Digital Money Summit, providing an excellent platform for sponsors, to showcase expertise and display leadership in their field, speaking to a global audience of public and private sector representatives. Sponsors of the Digital Money Summit can engage with attendees in bespoke virtual exhibition stands, and interact directly with speakers in private roundtables held during the conference.

Reasons to partner with the symposium:

- Receive insights into retail and wholesale central bank digital currency learnings from trailblazers including the People’s Bank of China, Banque de France, US Securities and Exchange Commission and Bank of Thailand

- Showcase innovative concepts, technologies and research to help the industry tackle challenges

- Enhance your organisation’s profile as a leader in the research and development of CBDCs

- Build business relationships and expand your network with world’s foremost members of the digital money community

If you would like to discuss Digital Money Summit 2024 partnership opportunities, please contact Folusho Olutosin at partnerships@omfif.org

Folusho Olutosin

Commercial Director

partnerships@omfif.org

Steering group

DMI members

SUBSCRIBE

Subscribe to receive the Digital Monetary Institute updates in your inbox, including upcoming meetings, podcasts, reports and the DMI journal