Q3 2024

Development finance asset class proves stable and strong

Emerging markets face the most pressing need to respond to the immediate impacts of climate change, writes Manfred Schepers, founder and chief executive officer, ILX Fund I.

At a time when sustainable development and climate finance investments are more important than ever, the recent effort by the Global Emerging Markets Risk Database Consortium to increase transparency by publishing credit recovery statistics is a key milestone.

The GEMs Consortium has been collecting and aggregating credit data from all multilateral development banks and numerous development finance institutions since 1998. Recently, the World Bank’s private sector arm, the International Finance Corporation, and the European Bank for Reconstruction and Development disclosed their aggregate credit performance data, including their emerging markets sub-sovereign private sector default and recovery rates.

The aggregate data demonstrates that the development finance asset class – hence the global loans that MDBs make to the sub-sovereign and private sector in emerging markets – has had a very stable and strong credit performance, based on relatively low defaults and high recovery rates. This is consistent across 19 MDBs and DFIs (Figure 1), in over 110,000 projects, including all economic sectors and EM regions.

Figure 1. High recovery rates across all EMs

Recovery rates for contracts of private counterparts by 2022 World Bank Group region

Source: GEMs Risk Database Consortium 2024

Since the 2008 financial crisis, capital flows to EMs through the international banking system and capital markets have become highly unreliable and have all but come to a halt. In particular, the domestic and local currency bond market development has stagnated in many EM countries.

Consequently, MDBs have now taken on an important systemic role across EMs, as was observed during the 2008 financial crisis, and again in response to the Covid-19 pandemic and the war in Ukraine.

The role of MDBs has become even more crucial since 2015, with the adoption of the United Nations’ sustainable development goals as the overall framework for public policy and the Paris Climate Accord as the global commitment to combat climate change.

It is self-evident that the greatest challenges in reaching the SDGs and climate objectives are in EMs. These regions have low economic and social development, high levels of unemployment, migration and greenhouse gas emissions. At the same time, EMs face the most pressing need to respond to the immediate impacts of climate change.

MDBs are well placed to address EM challenges. With decades of EM investment experience, local networks, sector expertise and financing capacity, they are at the forefront of providing long-term financing to private sector projects across EMs. With the key MDBs shareholders all facing fiscal constraints, it is essential that the institutional private sector, and in particular pension funds, is mobilised to co-finance alongside the MDB system.

Institutional investors can greatly benefit from the expertise of MDBs and DFIs in emerging markets by investing via innovative fund vehicles such as ILX Fund I, an asset manager specialising in global development finance co-investment strategies. With parallel long-term strategies, pension funds and other institutional investors are well-equipped to make long-term investments alongside these institutions.

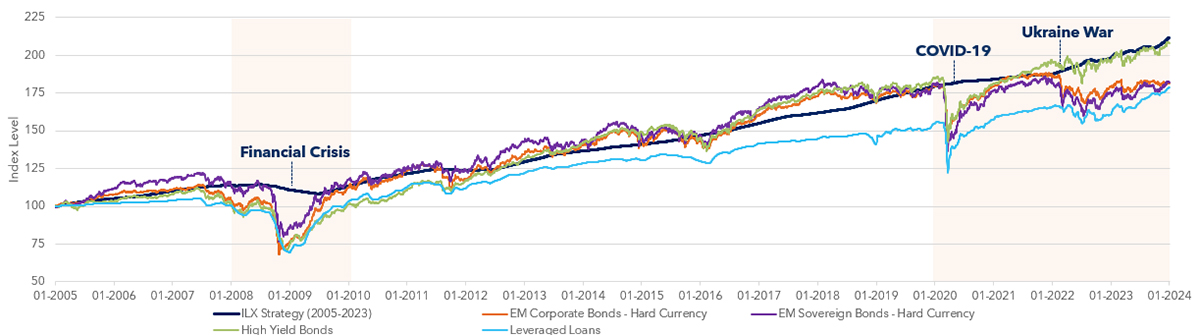

Yet, co-financing alongside MDBs is not only necessary, it is also a smart business decision. As the GEMs credit data demonstrates, the credit losses on the sub-sovereign and private sector loans have been significantly lower than those in comparable sub-investment grade fixed-income markets, such as high-yield, emerging markets debt and leveraged loan markets (Figure 2).

The analysis of the development finance asset class shows that, when combined with the average credit margins – the earnings MDBs make on their loans – this globally diversified asset class has delivered total returns that are more stable and, in the long term, higher than those of comparable asset classes in which institutional investors have already invested trillions. Thus, the necessary increase to trillions for climate finance can in part be facilitated by shifting the sub-IG bond exposures to EM private credit alongside the MDBs and DFIs.

Additionally, the data shows that the use of blending and de-risking is not needed for investors who can invest in the attractive risk-return of the sub-IG development finance asset class. It could even harm the scalability by relying on concessions.

Figure 2. Asset class performance climbs against ILX strategy back-test

Cumulative return over Secured Overnight Financing Rate data

Source: ILX analysis

To achieve this shift in capital allocation, the development finance asset class will require more data transparency, as well as further harmonised and standardised reporting. It is time to demystify the asset class and ensure an effective mobilisation of private capital into emerging markets.