The Economist concluded in an article on ‘hikelandias’ – a group of eight economies that hiked interest rates sharply and much earlier than others – that inflation is getting under control and hikers can now cut rates comfortably. If we develop the argument further, it is instructive to compare the inflation path of countries that tightened money early with those that were far slower.

Czechia and Slovakia share common history and are some of the most highly industrialised economies depending on exports to European Union markets. Both have a large automotive industry: 10m Czechs and 5m Slovaks produce about the same amount of cars as 47m Spaniards or 217m Brazilians. Before the Russian aggression in Ukraine, both imported a major part of their energy supplies via pipelines from Russia.

The inflation waves were pronounced in both countries, but evidence suggests that a country with its own currency and monetary policy is better able to control inflation.

The Czech National Bank hiked higher and earlier than Slovakia. It was one of the first central banks to react to the approaching wave of inflation, raising its policy rates to 7% in mid-2022 from 0.25% in mid-2021. Slovakia, a euro area member since 2009, waited another year before raising rates. Between mid-2022 and Q3 2023, the European Central Bank, raised its main refinancing rate to 4.5% from zero. The ECB policy was more cautious because average inflation throughout the euro area, although high, was much lower than in central and eastern Europe.

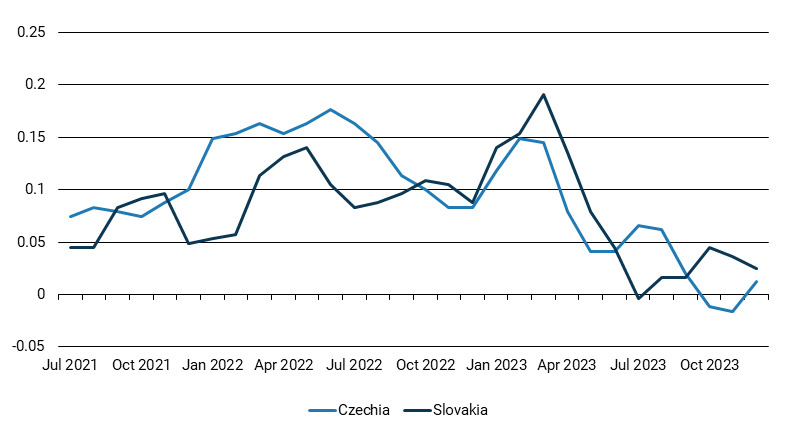

As inflation in Czechia and Slovakia was largely driven by external factors and the price of energy, it is better to focus on the behaviour of core inflation, which reflects mainly domestic demand-driven factors. Given inflation varied wildly in this period, I am using the moving averages of the core inflation to smooth out the data. The charts show the annual inflation rate implied from the last three month-on-month changes of core inflation instead of simply noting the last 3-month average of monthly increases (Figure 1).

Figure 1. Czechia brought stronger inflation under control quicker

Implied annual core inflation from month-on-month changes, %

Source: Czech National Bank, Eurostat

It is clear that both countries experienced an inflationary wave from the second half of 2021. In both cases the peak rates exceeded 15% and approached 20%. The Czech inflationary wave started earlier and exceeded the Slovak numbers until Q3 2022.

However, the CNB’s stricter monetary policy compared to the ECB has resulted in Czech core inflation staying below the Slovak numbers since October 2022, with the exception of a brief period in Q3 2023. The CNB’s greater restrictiveness appears to have brought stronger inflationary pressures under better control.

It remains to be seen if this trend continues. It is helpful that, even with abating inflationary pressures, the CNB has taken a relaxed line over the weakening exchange rate. This is likely to benefit the slack Czech economy, hit by problems in industry and tourism and dependence on German industry. The same headwinds are slowing down Slovak output, too. Hopefully, the ECB’s approaching cuts will be enough to drive the Slovak economy to better performance.

A comparison of these two central European economies yields some useful lessons. They have similar industrial structures. Both have been hit by a halting of Russian energy exports and the problems of the once mighty German industrial machine. The conclusion is that the CNB’s independent monetary policy has led to better control of inflationary pressures. This is perhaps not surprising for economists, but still a calming observation in a time of extraordinary shocks.

Miroslav Singer is Director of Institutional Affairs and Chief Economist at Generali Group and a former Governor of the Czech National Bank.

Join ‘The economic outlook and monetary policy in CEE‘ on 22 February for more on this topic.