Looking at ways to add incentives is crucial for sovereign debt management offices to ensure the primary dealership is financially viable for banks in the long term, especially during periods when issuers have higher funding needs and obligations for dealers are harder to meet.

‘In most primary dealer systems, primary dealers need to achieve a minimum share of the primary auctions. So, in the moments where the Treasury is issuing more debt, of course the primary dealers are having to buy more debt too,’ said Luis Felipe Vital, head of public debt operations at Brazil’s National Treasury. Vital was speaking at the launch event of the Public Sector Debt Outlook 2023 report by OMFIF’s Sovereign Debt Institute.

This is exactly what has been happening since 2020. Sovereigns have been issuing more debt to cover the financing needs related to the Covid-19 pandemic. As a result, primary dealers – the banks that buy and trade these bonds – have been struggling to keep up with the supply of debt and the obligations they have to maintain.

‘To keep a minimum share of the primary market, it’s harder for the primary dealers. What we understand is that, when we want to have a healthy primary dealer system, it has to be sustainable so financial institutions want to be part of this system,’ said Vital. ‘So every time sovereigns have to increase financing needs, of course we are going to have financial institutions asking for this model to be more sustainable. And this is going to be sustainable in the sense that we can arrange the system to give more incentives to keep the relationship good for both sides.’

Fee-paying syndications are the most obvious incentives for primary dealers, but there are other incentives such as greenshoe auctions where primary dealers can buy bonds offered at auction on the following day.

The Italian DMO has the most unique incentive scheme for primary dealers in that it pays fees to banks for participation in bond auctions.

‘We have been paying fees to primary dealers that participate in bond auctions with each primary dealer getting a fee proportional to the allotment and duration of the bond,’ said Davide Iacovoni, director general of public debt at Italy’s Ministry of Economy and Finance.

From the start of this year, the Italian DMO has made a change to the way it pays fees for auctions, with primary dealers receiving a slight reduction to their fees at the end of the year if their performance in the secondary market is ‘particularly unsatisfactory’, said Iacovoni.

The European Commission arrived with a primary dealer programme in 2021 as it launched itself as a super-sized borrower and has one of the largest primary dealer groups with 41 banks.

‘We have low entry levels and this why we have this wide group,’ said Siegfried Ruhl, Hors Classe adviser to the director-general for budget at the European Commission. ‘But if you want to play a bigger role and be eligible as a lead manager for our syndicated transactions, and we have a decent number of syndicated transactions, then you have to comply with higher criteria,’ said Ruhl.

As well as incentives, some sovereign DMOs have also eased their quoting obligations to dealers. Primary dealers have to provide regular quotes on bonds via electronic interdealer platforms which blend into a combined monthly score, with dealers having to meet a minimum score. Some DMOs have adapted that minimum score to ease the pressure on their banks.

The European Commission announced plans in December to introduce quoting commitments for its dealers from summer 2023 to further support secondary market liquidity. But Ruhl said this is likely to be more of a rewarding system than an obligation.

‘We will discuss details with our primary dealers and develop this together with them. The current idea is it will not be an obligation but, if you do it, you will be rewarded in gaining points for the internal ranking which increases the eligibility to lead mandates,’ said Ruhl.

Ioannis Rallis, head of sovereign, supranational and agency debt capital markets at JP Morgan, said obligations and incentives are key when deciding whether the bank joins a primary dealership.

‘Our first step has to be to consider whether we have the investor base to distribute the bonds,’ said Rallis. ‘We then look at obligations that the issuers are imposing on the primary dealers… and then the incentives and rewards offered by the issuers to primary dealers.’

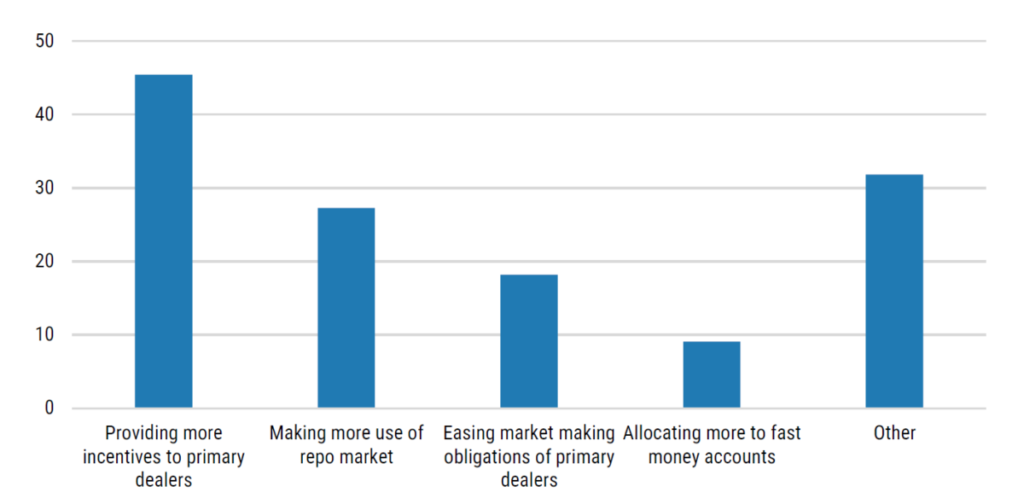

Figure 1. Primary dealers crucial to building trading volumes

How are you looking to boost liquidity?

Source: Public Sector Debt Outlook 2023

Source: Public Sector Debt Outlook 2023

In a survey of sovereign DMOs as part of the Public Sector Debt Outlook 2023 report by OMFIF’s Sovereign Debt Institute, 45% of respondents said they were looking to provide more incentives to primary dealers to boost liquidity. Meanwhile, 30% said they had experienced some of their primary expressing concerns about their obligations.

Burhan Khadbai is Head of Content, Sovereign Debt Institute, OMFIF.