Despite persistent promises to cut greenhouse gas emissions and transition to a net zero economy, institutional investors have been slow to take up environmental, social and governance investment. As climate risk becomes more acute, public funds are finally starting to walk the walk when it comes to sustainable finance — OMFIF’s 2022 Global Public Pension report revealed that public pension and sovereign funds are leading the way on financing the sustainable transition among institutional investors.

In particular, the deep pockets of public pension funds, their long-term time horizons and a mandate to serve their members make them a better fit for sustainable investment — as well as transition finance — compared to their peers.

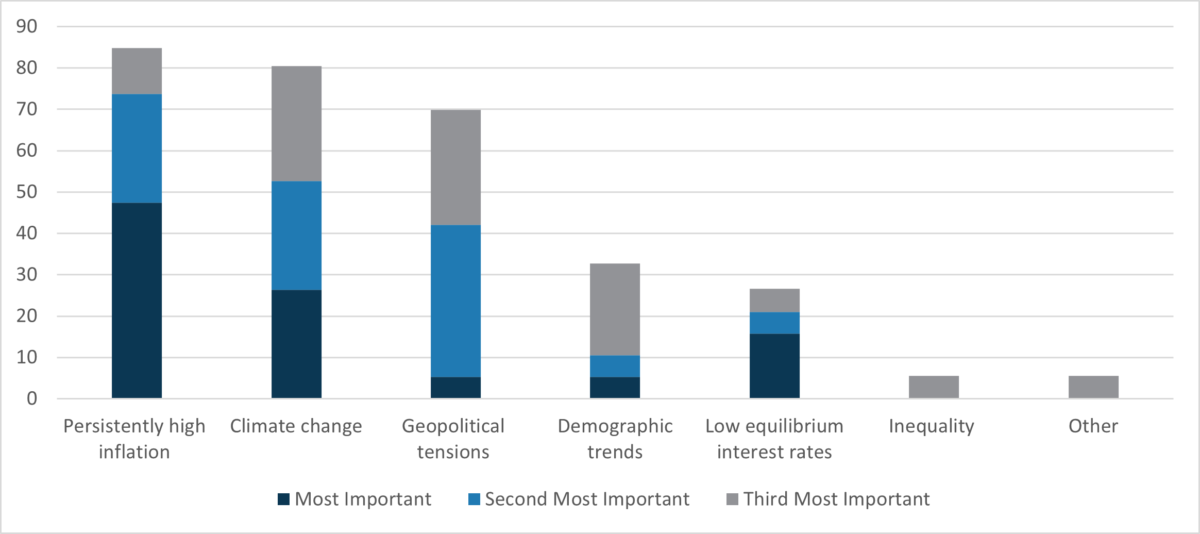

Data from GPP 2022 show that climate change was funds’ second most reported major concern over the medium to long term, after inflation. Most funds (80%) reported climate change as within their top three medium to long run concerns, making it a more important factor than geopolitical tensions (70%), demographic trends (32%) and low equilibrium interest rates (27%) (Figure 1).

Figure 1. After inflation, climate change is seen as GPFs’ most important concern over medium to long term

What are the most important economic challenges affecting your investment approach over the medium to long term? Share of respondents, %

Source: OMFIF GPP survey 2022

Source: OMFIF GPP survey 2022

Speaking at the launch of OMFIF’s Global Public Pensions report, James Ruane, managing director of capital solutions at CDPQ, explained that ESG is ‘integral’ to all investment decisions made by the $377bn Quebec-based pension fund. ‘Every team has a carbon budget. In terms of every investment we make, we benchmark the carbon intensity of that and think about, overall, how carbon-intensive the portfolio is.’

Indeed, concern over climate change is feeding into funds’ investment decisions: GPP 2022 data indicate that 76% of funds reported investing in ESG assets, a share which is growing. While the number of funds with green bond holdings increased modestly this year (up to 59% from 56% last year), the jump in green/sustainable equities stands out: the share of funds holding green equities increased to 59% from 38% last year. This upward trend in ESG asset adoption looks set to continue; most surveyed funds reported that they are looking to increase exposure to green investments over the next 12-24 months (Figure 2).

Figure 2. Broad interest to increase exposure to sustainable assets, particularly green bonds

Do you plan to increase, reduce or maintain your allocation to the following sustainable assets over the next 12-24 months? Share of respondents, %

Source: OMFIF GPP survey 2022. Note: ‘Maintain’ includes ‘Do not invest’.

Source: OMFIF GPP survey 2022. Note: ‘Maintain’ includes ‘Do not invest’.

For Ruane, ESG investments constitute just one aspect of CDPQ’s ESG considerations: ‘The other piece is how you engage with companies you’ve invested in,’ including on social and governance consideration. He explained that as an investor, CDPQ has been actively engaged with both publicly listed companies through voting processes and more directly with private equity investee companies.

There is broad-based interest among surveyed funds to finance the green transition through new and innovative projects. A vast majority (84%) of surveyed funds intend to invest in renewable industries (Figure 2). Moreover, most funds (58%) are also planning to invest in transitioning fossil fuel and/or emissions-intensive industries — the next frontier in tackling the net zero transition.

Transition finance, or transforming industries and firms from carbon-intensive and ‘dirty’ to green and/or sustainable ones, is anticipated to be both incredibly capital-intensive and require close and active monitoring to prevent greenwashing. Despite the challenges posed by this less regulated arena of ESG investment, some large public pension funds are already stepping up to the task.

For CDPQ as a responsible investor, the primary challenge in sustainable finance is how to ‘get the world to the right place’ on carbon neutrality. CDPQ has devoted a transition envelope of CAD10bn ($7.3bn) to help transition carbon-intensive companies. One project Ruane expressed particular enthusiasm about was providing debt financing for an energy generator in France and its overseas territories, which is working to transform coal-powered generators to being fully renewable. Based on survey data, it appears other pension funds are looking to invest in similar transition projects.

Figure 3. Share of GPFs planning to invest in renewables is twice that of those aiming to divest from fossil fuels

How is the green transition affecting your investment plans? Share of respondents, %

Source: OMFIF 2022 GPP survey

Source: OMFIF 2022 GPP survey

Regardless of what exact practices ESG investment strategies entail, data continue to be the biggest barrier for further ESG plans. The share of funds reporting insufficient data or lack of information as a hindrance to ESG adoption increased to 75% from 62% in 2021. An increase in the share of funds reporting data paucity as a barrier to ESG is also consistent with OMFIF’s 2022 GPI survey of central bank reserve managers. This is likely to be evidence of a greater share of funds looking to move into the ESG space, but being confronted with the same information challenges around a lack of reliable and standardised data.

Regulatory initiatives such as the Task Force on Climate-Related Financial Disclosures and the European Union’s sustainable finance disclosure regulation may provide a baseline for potential development of international or cross-jurisdictional standards. But for now, mandatory disclosures of ESG activities and risks, as well as standardisation of what counts as ‘sustainable’ investments, are lacking, especially on transition finance.

There is enormous potential for public pension funds to lead the way in financing some of the most daunting challenges of the net zero agenda, including transition finance. Their pockets are deep — the latest data available indicate that just among the largest 100 public pension funds globally, assets under management totalled $17.4tn — and many funds have already indicated willingness to channel capital toward sustainable projects. In order to unlock pension funds’ full potential as pioneering ESG investors, however, regulatory measures which bridge data gaps will be crucial.

Download OMFIF’s Global Public Pensions 2022 here.

Watch the entire OMFIF Global Public Pensions launch event here.

Taylor Pearce is Economist at OMFIF.