The hype about the demise of the G7 and the traditional system of financial governance has dominated the media in the last few years. However, the G7 is still going strong and the proposed alternative governance system – the Brics+ bloc – has not become operational.

Governance is enacted through multilateral organisations, such as the International Monetary Fund and the International Bank for Reconstruction and Development, through global banks, global financial markets and regulations.

G7 still dominates

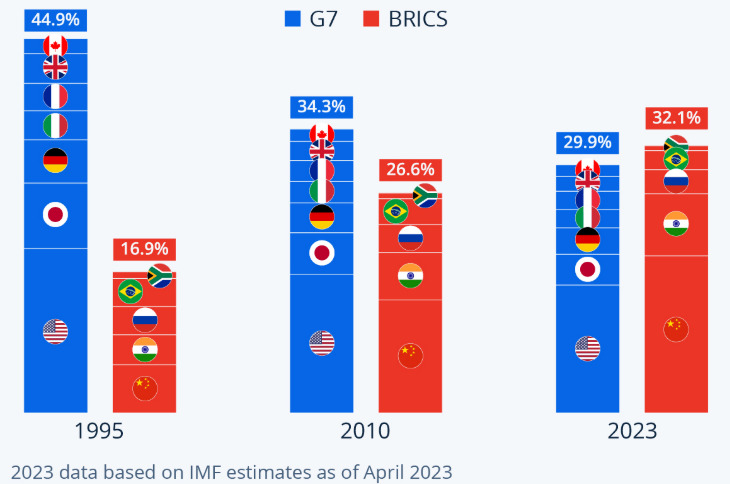

In 1995, the G7’s share of global gross domestic product was 44.9% in purchasing power parity compared to a combined 16.9% for the Brics bloc (Figure 1). In 2023, Brics overtook the G7 with a share of 32.1% compared with 29.9. But China is a giant in the real economy and trade and a dwarf in international finance, meaning the global financial markets are still dominated by G7 banks and financial markets. The G7’s share of world exports at 26.7% and inward direct investment at 31% still exceed that of Brics countries at 23% and 15%, respectively.

Figure 1. The rise of Brics

G7 and Brics countries’ share of global GDP in PPP

Source: Statista, IMF World Economic Outlook

The international banking market is dominated by US, British, Japanese, German, French and other European banks, according to the 2024 International Monetary Institute’s Bank Internationalisation Index. Chinese banks are big because of their domestic business, but their share of international activities is still smaller than G7 banks.

The G7 is even more dominant in the various sectors of financial markets. Money markets and global interbank markets are dominated by London, New York and Tokyo, as are the global foreign exchange markets. Global foreign exchange markets activity alone amounts to $7.5tn per day. The annual trade in goods and services is worth the same as five days of foreign exchange trading.

Although Chinese stock and bond markets are making some global impact, the global derivatives markets (notional amounts) amounting to a multiple of world GDP are still dominated by G7 countries.

Still in the planning stage

As the Brics Rio summit declaration in July showed, efforts to replace global financial governance are still at the planning stage. For example, the Contingent Reserve Arrangement to eventually replace the IMF has reached consensus by the technical team but no political agreement yet.

The Brics Interbank Cooperation Mechanism will be an acceptable mechanism of financing in local currencies once agreed upon. Brics has tasked the ministers of finance and central bank governors to continue the discussion on the ICM and Brics Cross-Border Payments Initiative.

Brics looks forward to the conclusion and implementation of the Strategy for Brics Economic Partnership 2030, which aims to consolidate mandates and guiding principles for the co-operation of the Brics group on issues relating to a multilateral trading system, digital economy, international trade, financial co-operation and trade and sustainable development.

Although China can play a more active and constructive role in global financial governance and promote reform of the international monetary system through renminbi internationalisation, China has not committed itself to take on such a role in global finance. Even the internationalisation of renminbi in 2025, as recorded by the IMI and Swift has declined slightly, supported mainly by outward direct investment, outward renminbi loans and cross-border trade settlement.

In the meantime, while China weighs the pros and cons of such an enhanced role, global banks and financial markets will continue to consolidate their global standing, facilitate the flow of finance, finance direct investment and manage various risks for their customers from G7 and non-G7 countries alike.

Herbert Poenisch is Senior Research Fellow at Zhejiang University.

Interested in this topic? Subscribe to OMFIF’s newsletter for more.