Gold prices are up roughly 25% this year alone. The European Central Bank reports that gold has overtaken the euro as the second largest reserve asset. Select emerging market authorities, China especially, are now major purchasers, reflecting concerns over US financial sanctions, geopolitical worries, reckless US fiscal policies and the unpredictability of President Donald Trump’s tariffs.

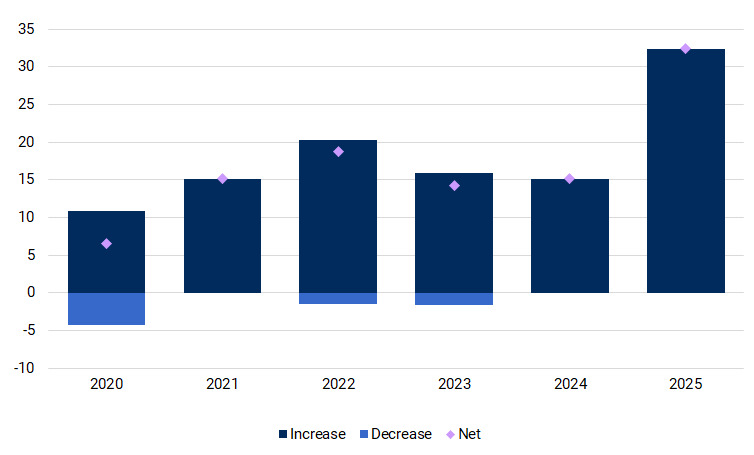

OMFIF’s Global Public Investor 2025 survey found that gold is currently the asset class most demanded by central banks, with one-third of surveyed reserve managers expecting to increase their holdings in the short term (Figure 1). The World Gold Council’s survey of central banks found that 95% of its survey respondents believe central bank gold reserves will rise in the next 12 months.

Figure 1. Central banks are going for gold

Over the next 12-24 months, do you expect to increase, decrease or maintain your allocations to gold? Share of respondents, %

Source: OMFIF Global Public Investor 2025

But are financial authorities using their balance sheets wisely and could the rush to gold diversification potentially be built on a house of sand?

Financial authorities face enormous fiscal headaches. They sit on massive gold stocks dwarfing annual gold demand. The four largest official gold holders alone – the US, Germany, Italy and France – together hold 16,000 metric tonnes of gold. Gold demand in 2024 was roughly 5,000 tonnes, of which central bank demand represented more than 20%, according to the World Gold Council.

In short, gold prices receive massive support simply because vast official stocks are held off the market. Were these official gold stocks responsibly sold, any upside for gold prices would most likely be capped, and prices might well fall. That would surely take the shine off gold.

Gold sales could reduce fiscal debt and financing pressures

These data points beg the question of why nations continue to hold their gold stocks. Gold no longer has an official role in the international monetary system, it generates no interest, is costly to store, and is less liquid and harder to sell than securities, for example. Even if one argues that holding gold stocks results in an appreciation for the national balance sheet, that is generating no flow of resources to officialdom.

Meanwhile, monetising gold stocks could generate resources for good use. For example, US debt held by the public is now roughly $30tn. US gold sales over time, using current market prices for illustrative purposes, could generate over $850bn for the US Treasury. That amount is admittedly a fraction of the debt held by the public. Nonetheless, reducing debt by such an amount could lessen pressures on interest rates, especially at a time of unsustainable fiscal deficits.

Figure 2. Percentage of gold in total reserves is still climbing

Value of gold reserves/total reserves, %

Source: World Gold Council

Similar arguments could be made for France and Italy – if the proceeds of their central banks’ gold sales could legally be used to reduce their government’s fiscal debt, indebtedness would fall by more than 5%. European gold sales might back efforts to reach the new 5% of gross domestic product spending target agreed by Nato members.

Again, gold stocks would need to be sold responsibly by official authorities. An uncoordinated rush to sell gold would send prices spiralling downwards. In 1999, after such a period reportedly led by the UK and Switzerland, European central banks signed the Washington Agreement on Gold, setting annual limits on official gold sales so as not to disrupt markets. When the International Monetary Fund sold limited quantities of gold after the 2008 financial crisis, efforts were made to contain market disruption. Such constraints provide important precedents for official gold sales.

Clash with realpolitik

Notwithstanding a cogent rationale for official gold sales, they are unlikely to occur because of a clash with realpolitik. There are many ‘gold bugs’ who atavistically believe gold could anchor a futuristic monetary order, or that a commodity-based international monetary system could better discipline inflation.

Gold-producing firms would lobby strenuously against any significant official gold sales, as they did when former UK prime minister Gordon Brown some 20 years ago proposed using IMF gold sales to finance the IMF’s part of the Multilateral Debt Relief Initiative. Some gold-producing developing countries might object. Plus, Trump can be expected to continue his erratic fiscal, trade and geopolitical policies.

Nations facing massive debts or financing needs would be well advised to consider responsibly selling their gold holdings, which inefficiently encumber their national balance sheets. Gold prices may be surging now on central bank diversification, for example by China and India, but that is primarily because massive official stocks are being held off the market.

If authorities were to responsibly sell gold stocks, it might quickly become evident that frothy headlines about gold and official reserve diversification were built on sand.

Mark Sobel is US Chair of OMFIF.

Join OMFIF on 10 July for a conversation with the Federal Reserve Bank of St Louis.

Interested in this topic? Subscribe to OMFIF’s newsletter for more.