A year must feel like a decade for public investors. Last year, our annual Global Public Investor survey showed the dollar was the most in-demand currency for reserve managers. Having recouped earlier losses, many were also willing to add risk to their portfolios. Fast forward 12 months and the script has flipped. Now there are growing questions over the dollar’s dominance in portfolios and public investors are seeking safe-haven assets.

OMFIF’s Global Public Investor has tracked central bank reserve managers’ investment strategies since its inception in 2014. In the first edition of the report, we wrote that ‘diversification into different sectoral and geographical categories is increasing’ owing to ‘sub-optimal returns from traditional currencies and instruments’ in a low interest rate environment.

For central banks, particularly those with growing reserves, there was appetite to move into higher-yielding currencies and riskier asset classes such as corporate bonds or equities. ‘Some official managers have reduced gold holdings to generate more balanced portfolios,’ we noted, adding that others were increasing gold weightings for the same reason.

Over a decade later, this year’s GPI report, based on a survey of 75 central banks, shows the appetite for diversification continues. But for very different reasons. The foundations of the global economic order, underpinned by globalisation and the dollar, are shaking.

Protectionism, geopolitical tensions and volatile policy-making are becoming norms. In this environment, close to 60% of surveyed central banks are seeking to diversify their portfolios within the next two years (Figure 1). This is primarily for risk management and resilience purposes, beyond bolstering returns.

Conducted from March to May this year, the survey revealed that 96% of reserve managers view US tariffs as a major geopolitical concern. This is not a temporary consideration: over 80% of reserve managers have geopolitics in their top three factors shaping longer-term investment decisions, ahead of inflation, real interest rates and technological change.

Figure 1. Diversification, accumulation and de-risking on the agenda

Do you aim to amend the following in your reserve management plans over the next 12- 24 months? Share of respondents, %

Source: OMFIF Global Public Investor 2025

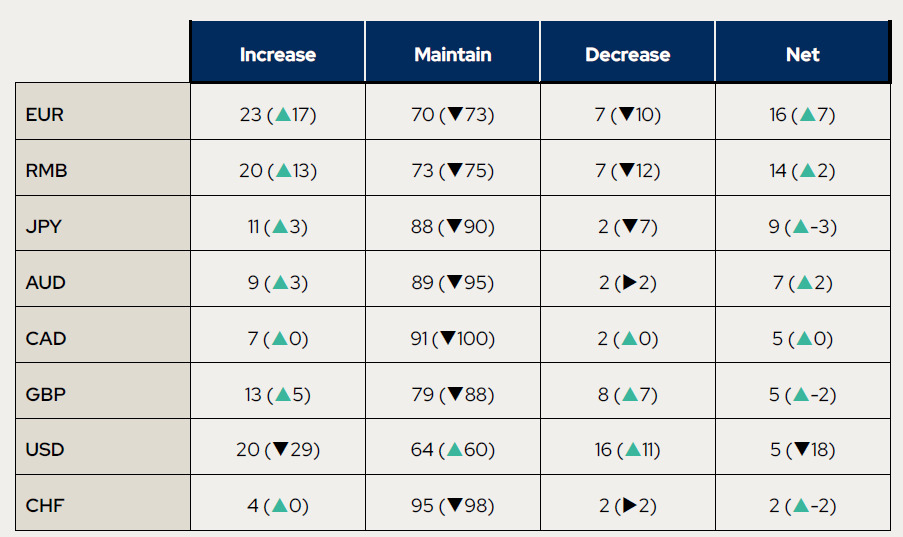

Reserve managers expect to move away from dollars and towards other currencies – especially the euro and renminbi – although this shift will be gradual. The dollar was the only currency that saw demand fall this year, while a net 16% of survey respondents intend to add to their euro holdings over the next two years, up from 7% last year (Figure 2). However, this preference is not across the board, with respondents from emerging markets more likely to add to their renminbi holdings.

Gold is shining brightest as a diversifier. A dedicated ‘in-focus’ section reveals the precious metal is the most demanded asset class for central banks, with 32% of central banks expecting to increase their holdings in the short term. Meanwhile, the shift towards corporate bonds and equities is likely to materialise over the next decade rather than in the next few years.

But the dollar’s reserve currency status is not yet under threat. Over 80% of central banks stated the dollar still provides safety and liquidity, and the vast majority expects it to constitute over 50% of global reserves over the next decade.

Figure 2. Dollar drops in the pecking order

Do you plan to increase, decrease or maintain your exposure to the following currencies over the next 12-24 months? Share of respondents, %

Note: Brackets show results from 2024. Columns may not add up to 100% due to rounding

Source: OMFIF Global Public Investor 2025

This year’s report also incorporates insights from a short poll of public pension and sovereign funds to understand how both groups of public investors are collectively responding to new pressures. The views from public funds paint a similar picture – more hesitance on US investments and less willingness to add risk to portfolios. For nearly every asset class, a larger share of respondents is choosing to maintain their existing allocations relative to a year before.

In total, the GPI draws on insights from 90 official institutions with over $7tn in assets. This provides an important snapshot into how public investors at the heart of global finance are adapting to current conditions. Our thanks as always go to all the central banks and public funds that have contributed to this report.

This year, OMFIF is launching the inaugural Global Public Investor Working Group project, formed by central banks and partner organisations, to explore the plans and tools that reserve managers can use to diversify their portfolios. The discussions will culminate in a report, publishing at the International Monetary Fund-World Bank annual meetings in October.

Nikhil Sanghani is Managing Director of OMFIF’s Economic and Monetary Policy Institute.

Download OMFIF’s Global Public Investor 2025.

Interested in this topic? Subscribe to OMFIF’s newsletter for more.