Financing climate transition in Asia Pacific

Multilateral development banks play an important role in helping emerging markets transition to low-carbon economies, writes Roberta Casali, vice president, finance and risk management, Asian Development Bank.

Global Public Investor 2023

OMFIF’s Global Public Investor report goes further than ever before to unpack reserve managers’ economic views, investment plans and internal operations.

Time for tougher scrutiny of sustainability-linked lending

Target-based lending must be used appropriately in Asia’s transition to a more sustainable future, write Andrew Ferguson, chief executive officer, and Juliana Shek, in house counsel, Asia Pacific Loan Market Association.

Financing a sustainable future in Japan

Careful and categorical mobilisation of finance is needed to transition from the present to the desired future, writes Satoshi Ikeda, chief sustainable finance officer, Financial Services Agency of Japan.

Moving beyond green bonds

Transition finance can be the engine needed to fuel a net-zero future, write Rachel Hemingway, head of transitions, Gabriela Constantin, industrial transitions programme manager and Oluwatoyin Oyekenu, Agri Foods programme manager, Climate Bonds Initiative.

Why transition finance must go beyond energy

A coherent and coordinated approach is required to effect a sustainable transition, writes Marcus Pratsch, head of sustainable bonds and finance at DZ BANK AG.

Paving the way for a greener tomorrow

Transition finance is not as clear-cut as green finance, writes Sarah Kemmitt, lead, secretariat, United Nations Environment Programme Finance Initiative.

Flexibility is the main appeal of transition finance

Local context should be taken into consideration but there are challenges for broad adoption, writes Marina Petroleka, global head of research, Sustainable Fitch.

The role of blended finance in funding the low-carbon transition

Where there are constraints on public funds, we must prioritise private sector capital for climate finance, write Prasad Ananthakrishnan, chief of climate finance and policy, and Charlotte Gardes-Landolfini, climate change, energy and financial stability expert, International Monetary Fund.

Net-zero progress: too little, not too late

A disorderly transition is still the most likely climate change pathway but there is still time to change this, writes Anna Stupnytska, global macro economist, solutions and multi-asset, Fidelity.

A robust transition plan is the way for firms to meet net zero

Integrating a credible climate transition plan will enable firms to take ownership of changes to come, write Kate Levick, associate director, sustainable finance, E3G, and Ben Caldecott, director and principal investigator, UK Centre for Greening Finance and Investment; co-heads of the Transition Plan Taskforce Secretariat.

Mobilising transition finance in the Asean region

Kelvin Lester King Lee, commissioner, Securities and Exchange Commission, Philippines, spoke with Edward Maling, research analyst, OMFIF, on unlocking finance for transition.

Exploring debt-for-nature swaps in climate action

This roundtable explores the mechanism of debt swaps for climate and nature, challenges and opportunities for public and private sectors as well as what it would mean for the international financial system in the face of the climate crisis and biodiversity loss.

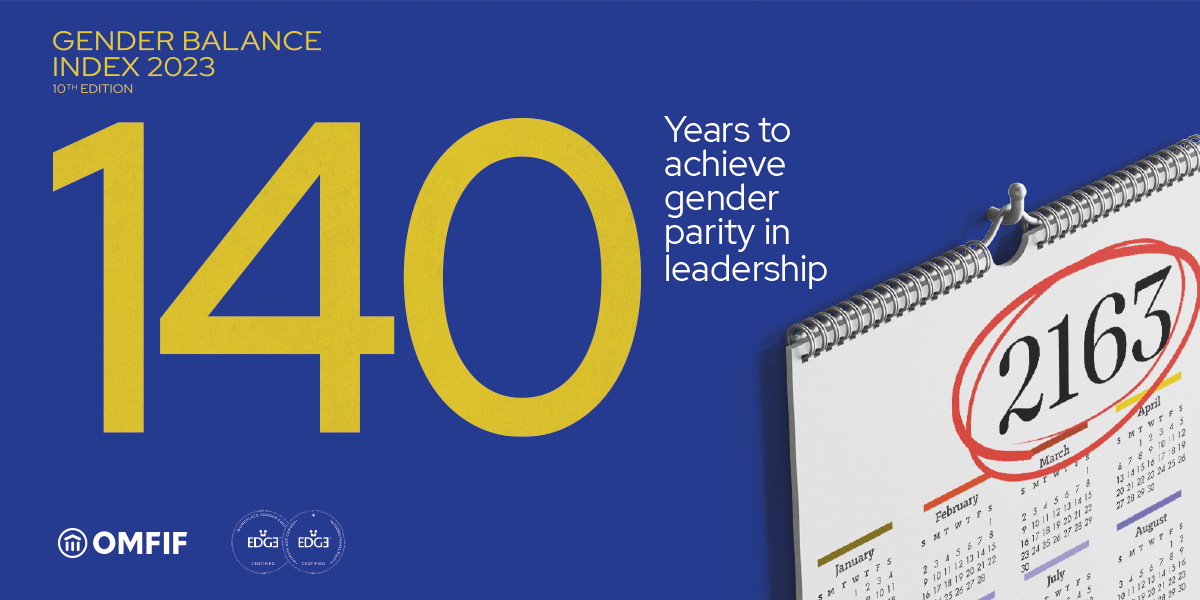

Gender Balance Index 2023

Men’s dominance at the top of central banks and financial institutions is unlikely to change any time soon. OMFIF’s Gender Balance Index 2023, now in its 10th edition, finds that, at the current rate of progress, it will take 140 years to achieve parity between men and women in leadership positions in the industry.

In conversation with the United Nations

This podcast discusses how the United Nations is working to converge regulatory and policy frameworks to catalyse energy efficiency and security, while scaling clean energy production and increasing decarbonisation.